The Takeaway

77% of companies in the Morningstar US Market Index conducted share buybacks for at least two consecutive years while 59%, 38% and 15% have done so for three, five and ten consecutive years respectively.

Returns and volatility of returns increase as we tilt the portfolios from dividends towards buybacks. Dividend-skewed portfolios exhibit a lower downside capture ratio and thus provide better downside protection as compared to their buyback counterparts.

From a sector perspective, the dividend-focused portfolios have higher exposure to defensive areas relative to their buyback-focused counterparts. For the buyback-focused portfolios, a relatively higher exposure to cyclical sectors leads to more volatile sector weights.

Stock buybacks in the US market reached historic highs in 2021 and 2022 by dollar value. Companies included in the Morningstar US Market Index conducted $921.9 billion worth of share repurchases in 2021 followed by $1,010.1 billion in 2022, well surpassing the dividend payout of $586.1 billion and $646.3 billion during the same years, respectively.

An investor relying on dividends alone might overlook companies that repay capital to shareholders primarily via stock buybacks. Both dividends and buybacks are a form of capital repayment to shareholders, and according to Modigliani and Miller’s theorem, investors should be indifferent between receiving capital distributions via dividends or buybacks. While the irrelevance theorem may hold true from the shareholder's perspective, emphasizing dividends versus buybacks, at the portfolio level, involves consequences. In our analysis, we conclude that investment strategies focused on different forms of shareholder payout come with trade-offs related to income, risk/return, and sectoral biases.

Recent Performance

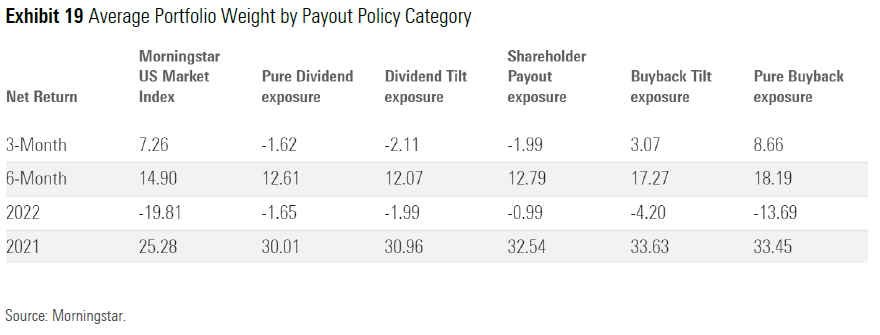

The three-month period ended March 31, 2023, saw the Morningstar US Market Index in positive territory. Portfolios with a buyback orientation have outperformed the US Market Index as well as their dividend-oriented counterparts. In 2022, on the other hand, the Morningstar US Market Index fell by 19.81%. The dividend-oriented portfolios outperformed the US Market Index as well as the buyback exposure portfolios in the down market. The shareholder payout portfolio provided better returns than both the pure dividend and pure buyback exposure portfolios during the 2022 market decline. If 2022 is evidence, marked by the poor performance of pure buyback portfolio, having some exposure to dividends provides a downside cushion to the portfolio.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.