The Rise of Unicorns

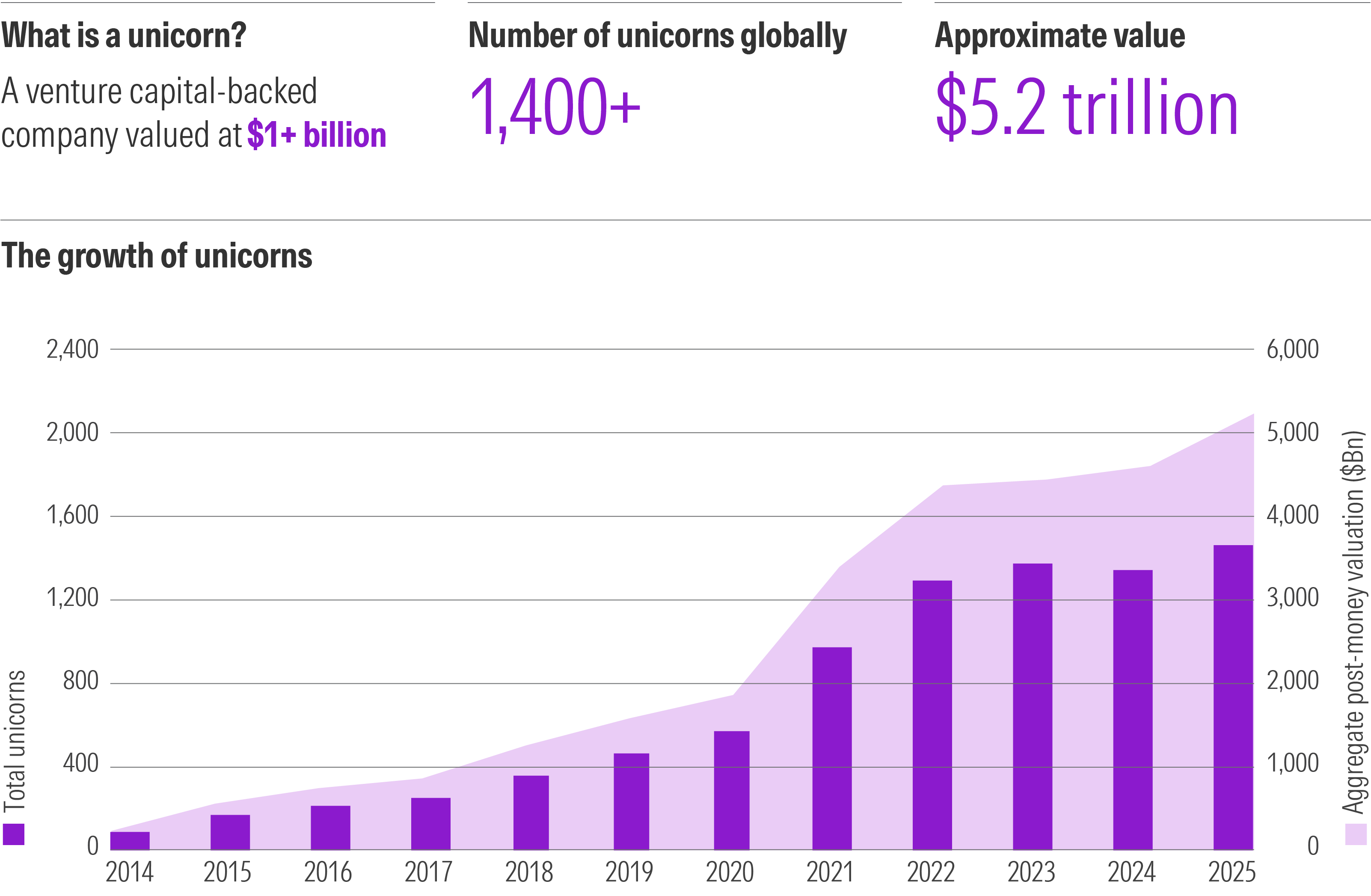

The rise of private markets has been one of the most significant developments in capital markets in recent years. One mark of this rapid growth is captured in the burgeoning number of unicorns. Beyond a measure of valuation, unicorns embody the innovation within — and investment potential of — the venture ecosystem.

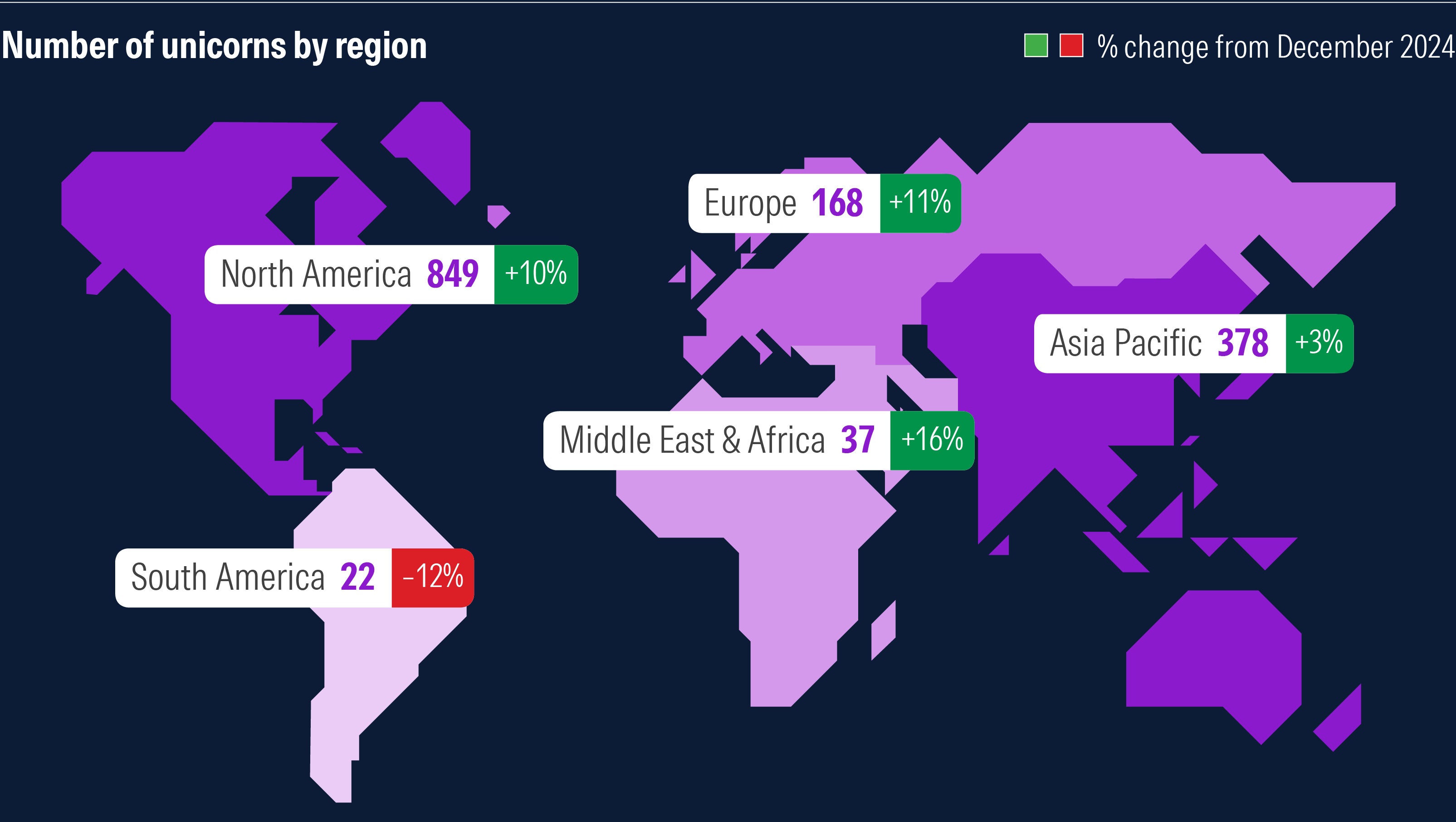

Not Just a Silicon Valley PhenomenonWhile the US continues to be the primary home for unicorns, other countries have seen phenomenal growth in recent years. China and India lead the charge, representing 20% of unicorns by count. European countries are also on the rise with an 12% share. |

|

|

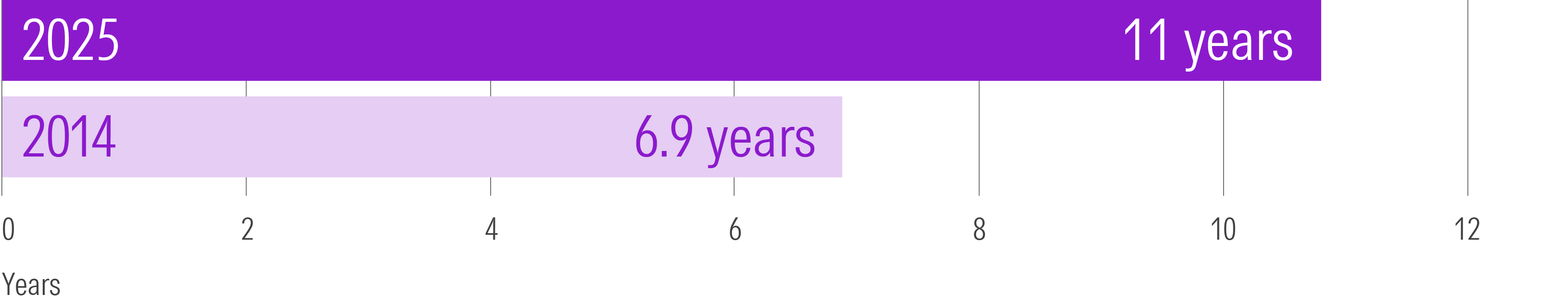

Companies are Staying Private Longer

Private companies are taking longer to go public, with the median age increasing from 6.9 years in 2014 to 11 years today. Record funding, regulatory changes, and non-traditional investors are driving this trend.

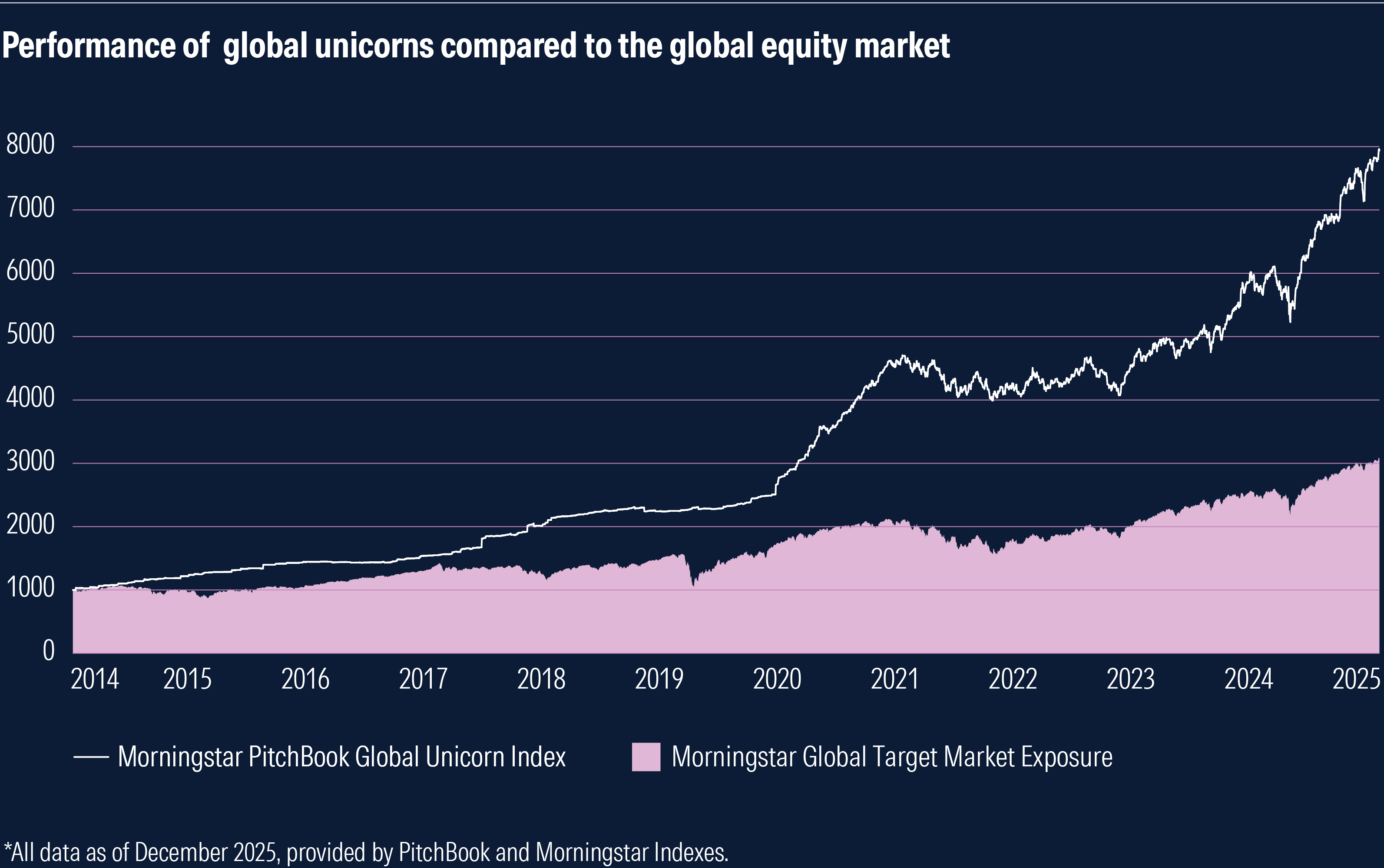

A Window Into the Innovation EconomyUnicorns play an important role in shaping today’s investment landscape. The Morningstar PitchBook Global Unicorn Indexes are designed to bring transparency to this segment of capital markets and provide valuable insights into the drivers of future economic growth. |

|

Learn More

Explore our range of private market indexes to gain a more complete picture of capital markets.

About Us

Morningstar Indexes

Morningstar Indexes was built to keep up with the evolving needs of investors—and to be a leading-edge advocate for them. Our rich heritage as a transparent, investor-focused leader in data and research uniquely equips us to support individuals, institutions, wealth managers and advisors in navigating investment opportunities across major asset classes, styles and strategies. From traditional benchmarks and unique IP-driven indexes, to index design, calculation and distribution services, our solutions span an investment landscape as diverse as investors themselves. Please visit indexes.morningstar.com for more information.

PitchBook

PitchBook is a research firm and financial data provider that empowers global capital market professionals to win what’s next. We collect and analyze information on the entire investment and business lifecycle. Our data, research and insights are available through our in-depth reports, industry news, and robust platform. To learn more about PitchBook, visit pitchbook.com or contact info@pitchbook.com.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.