The Takeaway

Banks may benefit from rising interest rates, but tighter borrowing costs also bring negatives for the financial services sector. When it comes to rates and banks, magnitude matters, and the broader context is key.

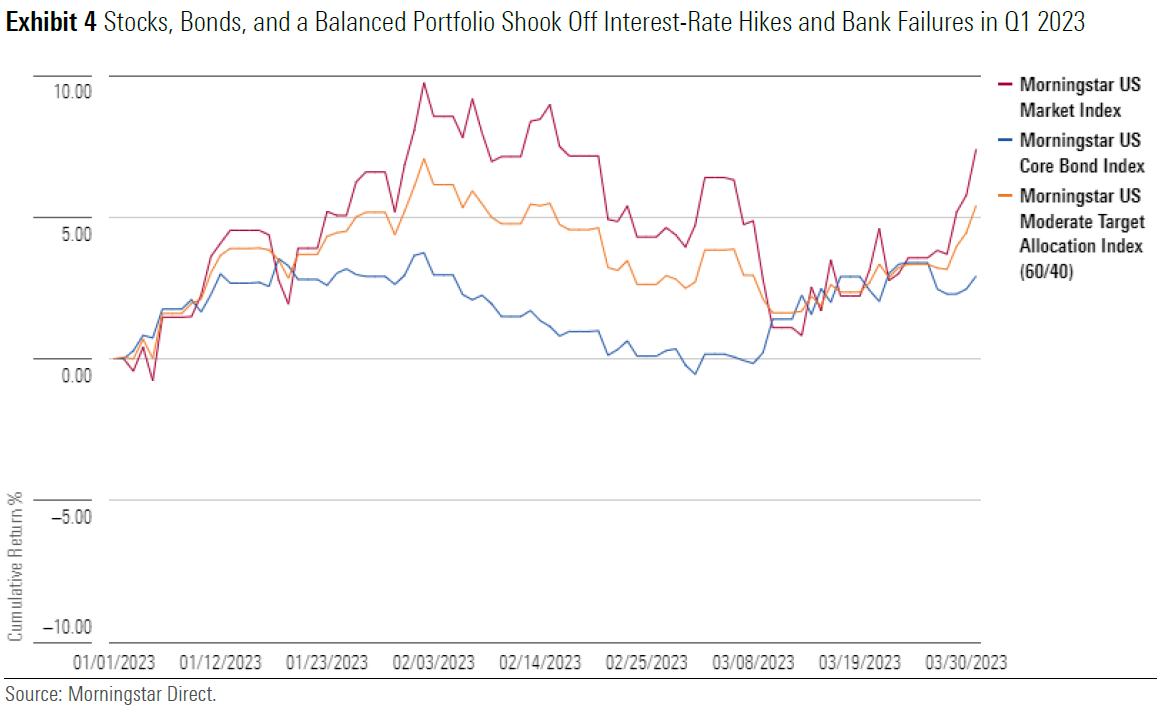

Bonds have provided a port in the storm in 2023. While asset class diversification didn’t help much in 2022, the fact is that investment correlations are always bouncing around.

Bank failures have opened up potential opportunities in the financial services sector, while bonds have a lot going for them.

Just as Russia's invasion of Ukraine made few lists of top risks going into 2022, prognosticators missed bank failures as a likely scenario for 2023. This year we've seen runs on financial institutions linked to venture capital and cryptocurrency, as well as the demise of a 167-year-old Swiss bank. That was just in March. While the Federal Reserve and other central banks have continued to hike interest rates to combat inflation, the Morningstar Global Markets Index, a broad gauge of equities, and the Morningstar Global Core Bond Index, have both logged solid gains so far in 2023.

Remember that in 2022, rising rates were blamed for steep losses in both stocks and bonds. Obituaries were written for the 60/40 portfolio, as the two major asset classes exhibited a positive correlation. Within equities, the shares of some of the most profitable, best-positioned companies sank furthest, widely pinned on higher rates taking a heavier toll on growth stocks. Meanwhile, slow-growing dividend-paying stocks held up well, defying the old saw that rising rates make dividends less attractive.

Now, rising rates are being held responsible for bank failures. Aren't higher interest rates supposed to be good for banks? Meanwhile, no one is complaining about a breakdown in asset-class diversification this year because equities and fixed income are simultaneously rising. Investment performance in 2023, like 2022 before it, has both surprised us and upended conventional wisdom.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.