The Takeaway

European equities have posted solid returns even as the European economy has stagnated. The dichotomy is a reminder that economies and markets can diverge. Asset prices are affected by a range of forces: macro and micro, foreign and domestic. Company-specific factors are key.

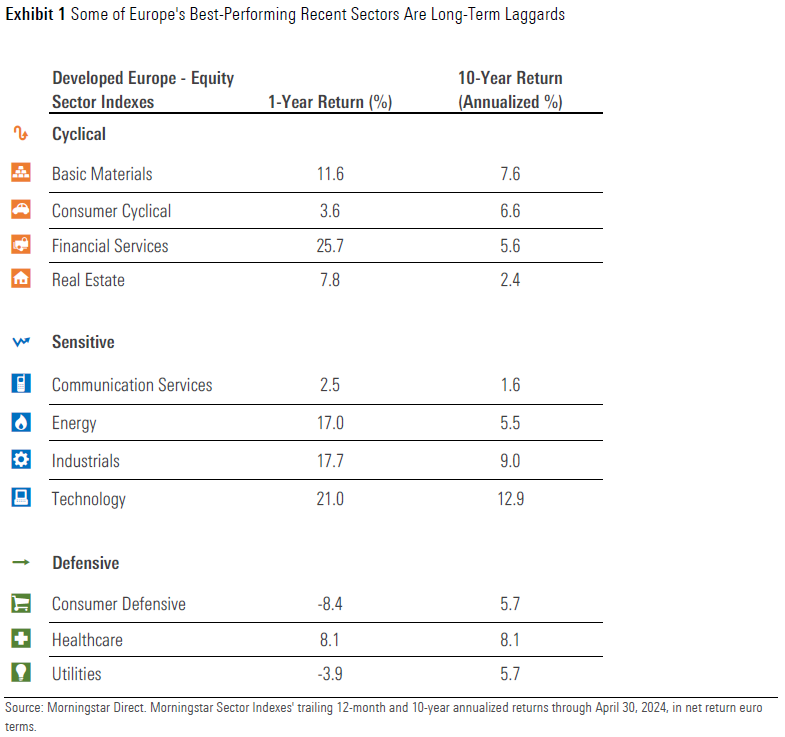

Some of the past year's best-performing European equity sectors, such as financials and energy, have been long-term laggards. Technology and industrials have posted strong short- and long-term returns.

Looking forward, Morningstar Equity Research sees opportunity across European equity sectors. Most sectors are trading at discounts to intrinsic value. Within sectors, secular growth drivers are plentiful.

Europe is hardly a picture of economic dynamism at the moment. While the US defies predictions of both a hard and soft landing, Japan shakes off decades of deflation, India booms, and China registers "disappointing" gross domestic product growth rates of 5%, Europe is stagnating. Germany, its largest national economy, contracted in 2023. The continent overall is stuck near zero growth.

Yet, European equities have posted solid recent returns. Over the past year, the Morningstar Developed Europe Index has risen 11% in euro terms—not as high as its US counterpart—but a strong absolute gain. Novo Nordisk of Denmark has seen its share price soar as a result of its weight loss therapies. Netherlands-based ASML has ridden global demand for semiconductor manufacturing. Higher interest rates have benefited banks across the region, while higher oil prices have lifted energy companies.

Analysis of Morningstar's European sector and industry index range can help explain the disconnect between the macroeconomic backdrop and equity returns, as well as the mixed fortunes across market segments. Morningstar Equity Research's company-level price/fair value estimates reveal risk and opportunity across markets.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.