The Takeaway

Value, momentum, quality, and low volatility have been widely vetted as factors historically associated with strong performance. While each of these factors has a strong long-term record, they all experience cyclicality.

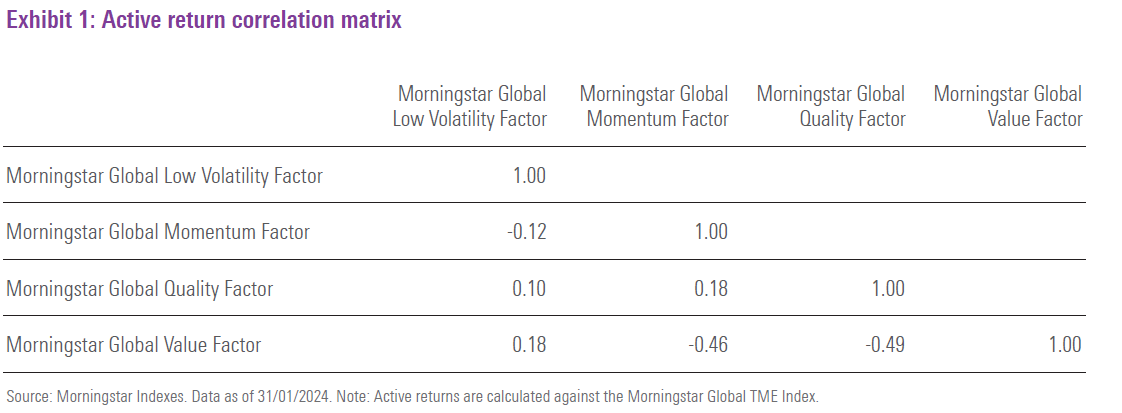

Diversification across factors can reduce the risk of underperforming the market, while allowing investors to participate in the upside.

The Morningstar Global Multifactor Indexes leverage a bottom-up optimization framework to maximize portfolio-level factor exposures under a set of constraints to improve diversification, including maintaining equal active exposure to each of the targeted factors. This strengthens factor exposures relative to a simple combination of single factor portfolios, while mitigating lopsided factor exposures that many bottom-up frameworks can introduce.

It has been widely documented that individual factors like value, quality, momentum, and low volatility, have been associated strong risk-adjusted performance over the long-term. Yet, like any investment strategy, these can all experience long stretches of underperformance, as the experience of the value factor over the past decade demonstrates. Factor performance cyclicality is inevitable, yet difficult to time. Diversification across well-vetted factors is a more compelling approach that can reduce risk and make it easier to stick with factors through their rough patches.

The Morningstar Global Multifactor Indexes can be effective tools to diversify factor risk. These indexes target value, momentum, quality, and low volatility, using optimization to maximize portfolio-level factor exposures under a set of constraints to improve diversification and limit turnover. This includes maintaining equal active exposure to each of the targeted factors.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.