Index Insights

Value Outperforms Growth in the Small- and Mid-Cap Arenas

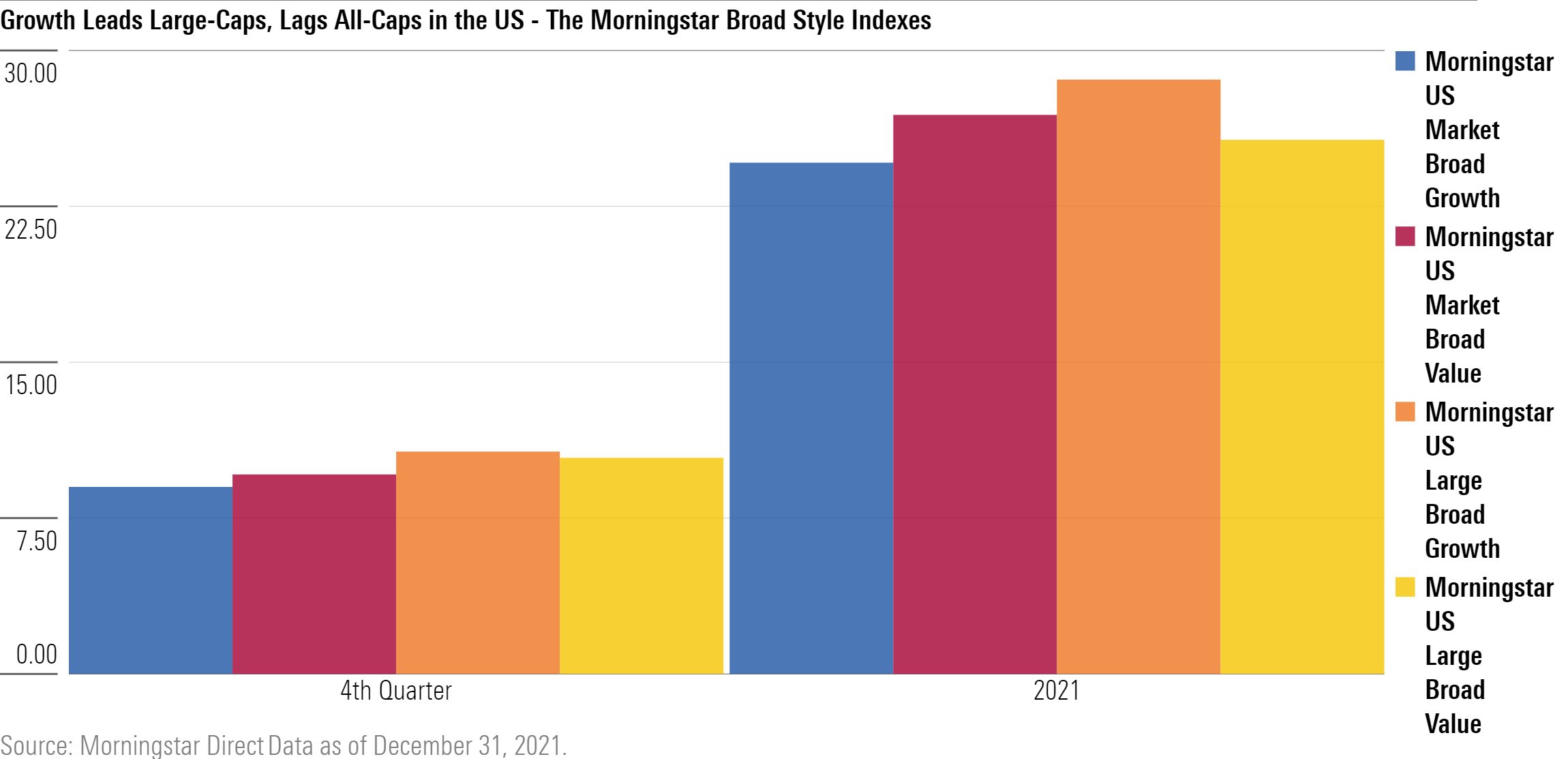

While growth-oriented stocks continue to lead in the US large-cap arena, it’s actually value that led growth across the small- and mid-cap tiers in the fourth quarter and all of 2021, according to the latest Morningstar Quarterly Style Monitor.

The new report, authored by Morningstar Equity Indexes Product Manager Nick Johnson and based on performance of the Morningstar Broad Style Indexes, suggests there may be a sustained market rotation into value-oriented and smaller-cap stocks in the US.

Nick Johnson, Equity Product Manager, Morningstar Indexes:

“Applying a style framework focused on size and valuations may help investors to navigate the US equity market and, in part, propelled the seminal launch of the Morningstar Style Box in 1992. The style framework tells a very interesting story in 2021, confirming that, while growth continues to dominate the large end of the market cap spectrum, value investors did better in the mid- and small-cap areas. Growth stocks within the large-cap band have not been insulated either, as evidenced by the performance spread between large-growth and large-value compressing meaningful over the past year.”

Past performance is no guarantee of future results. Indexes are not available for direct investment. Please consider investment objectives, risks, charges and expenses prior to investing.

Andrew Ang, Head of the Factor-Based Strategies Group at BlackRock:

“The most recent dynamics of value vs growth, especially in the fourth quarter of 2021, have all been about the return to normalcy vs social distancing: value firms have more physical capital and benefit more from physical interactions as we return to normalcy. Going forward, we expect a favorable environment for value with rising rates and persistent above-trend inflation. We favor value at this point in the economic cycle because in approximately a century of data, value firms have historically outperformed in regimes of middling and high inflation regimes, and value firms have also historically outperformed during cyclical upswings.”

The Morningstar Broad Style Indexes, a family of indexes designed to accurately represent the full opportunity set available to style investors to enable precise performance benchmarking and efficient asset allocation aligned with the Morningstar Style Box.

For a copy of the Morningstar Quarterly Style Monitor or to speak with Nick Johnson, please contact Tim Benedict at (203) 339-1912 or tim.benedict@morningstar.com.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.