Index Insights

US Styles Race-to-the-Finish

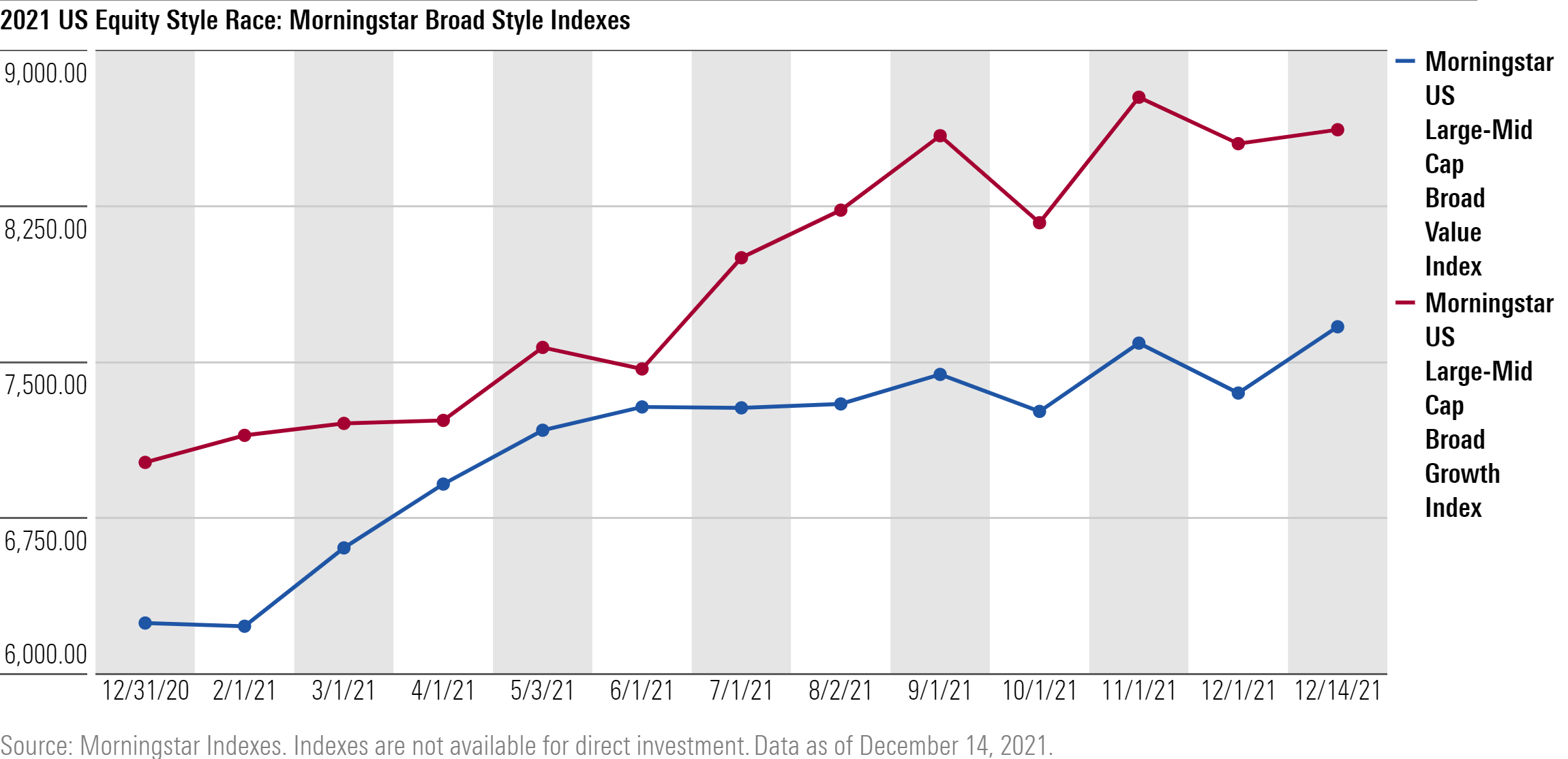

Growth-oriented US stocks look poised to win the 2021 US Style Race, but investors can find more opportunity on the Value side of the market.

Value and Growth are running neck and neck as we approach the finish line for 2021, and while Growth appears poised to win the 2021 performance race, going forward the Value side of the US equity market appears to hold more upside, according to new insight from Morningstar Indexes.

“It looks like Growth will win again in 2021, a very strong year across the board for US equities,” according to Morningstar Indexes Strategist Dan Lefkovitz. “Value stocks, which tend to be more economically sensitive, started the year strong, but as the Pandemic dragged on, Growth rebounded and overtook Value. Big winners include NVIDIA, Microsoft, Alphabet, Tesla and Moderna, which have driven performance for the Morningstar US Large-Mid Broad Growth Index.”

Yet while growth-oriented stocks have led the US equity market over the longer term, Lefkovitz does see opportunities on the Value side of the market going forward.

“While Growth has clearly led the US equity market for the last decade, style leadership has historically been cyclical and the coming years could be better for Value. From a macro standpoint, Value stocks have tended to do better during inflationary periods. And our bottom-up, fundamental research analysis at Morningstar has identified certain stocks which may offer value. These include a number of misunderstood company-specific stories on the Value side of the market including GE, which should benefit from its recent restructuring, Kraft Heinz and Kellogg. And traditional energy stocks such as Chevron and Occidental may benefit as the market underestimates demand for traditional energy sources going forward.”

To speak with Dan Lefkovitz, contact Tim Benedict at (203) 339-1912 or tim.benedict@morningstar.com.

©2021 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.