US Treasury Inflation Protected Securities (TIPS) have roared back since the start of the Russian Ukraine invasion into Ukraine, while Treasuries sink further into loss territory as investors brace for the possibility of stagflation.

Just a month ago, before the Russian invasion of Ukraine, the Morningstar US TIPS Index hit a year-to-date low, with a 4.1% decline as of February 16. Today, we see a different story, with the Index up 0.5% in the first 10 trading days of March. This follows a meteoric rise of nearly 2.9% over the course of two days in late February for the Index as the Ukraine crisis began and investors felt the immediate effects of the conflict with surging oil prices.

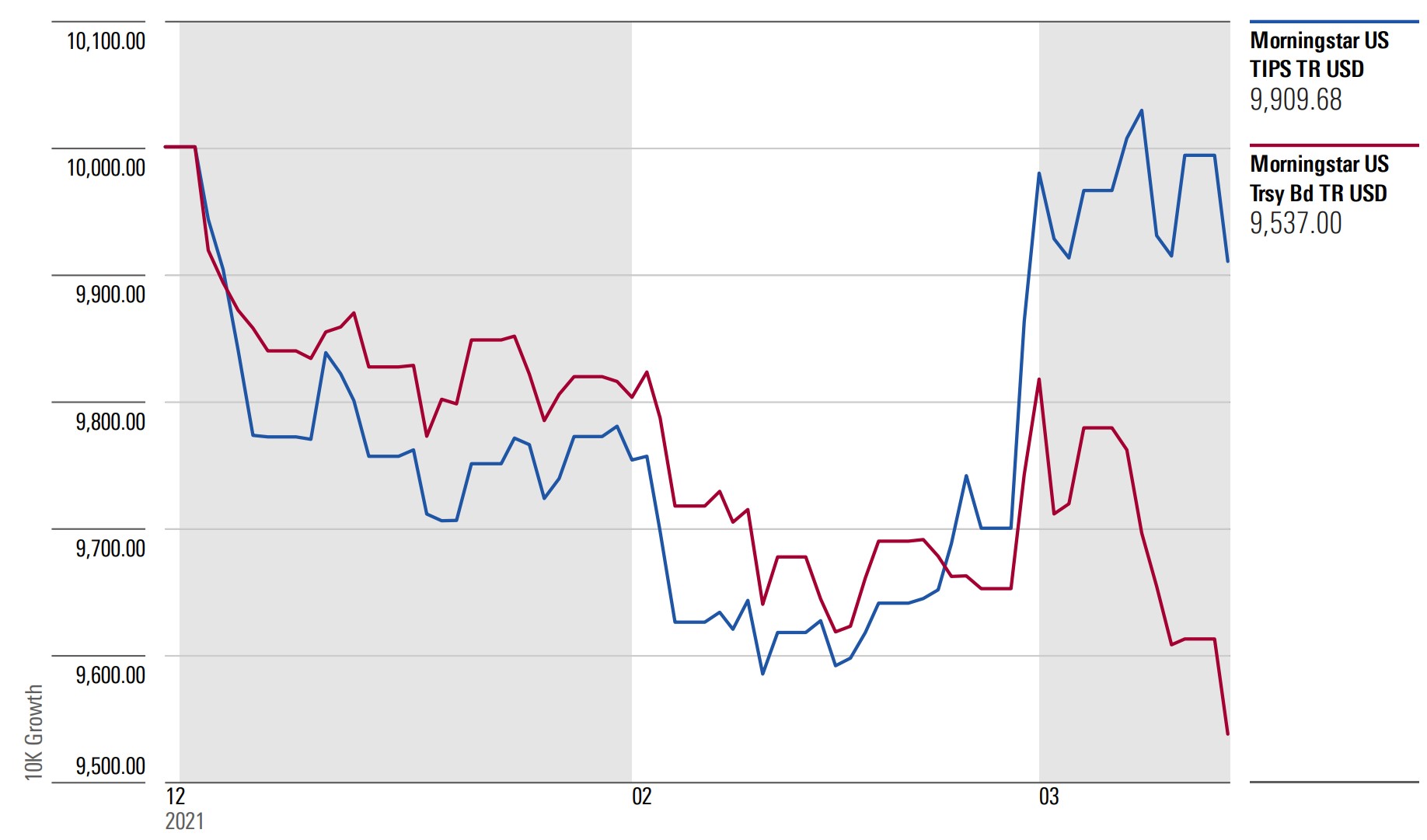

The chart below compares the year-to-date performance for the Morningstar US TIPS Index, measuring the performance of all TIPS that have a maturity greater than one year and a 6.65 duration as of March 15, to the Morningstar US Treasury Index, which measures the performance of fixed-rate, investment-grade USD-denominated Treasury bonds with maturities greater than one year and a 6.78 duration as of March 15.

Source: Morningstar Indexes. Indexes are not meant for direct investment.

Now, on the heels of the FOMC announcement on interest rates, yields on the US 10 Year have rallied from the initial flight to safety at the outset of the invasion, soaring more than 50 bps in the last two weeks to 2.14. US Treasury bond prices fall as yields rise, sinking the Morningstar US Treasury Bond Index deeper into loss territory at -4.63% YTD as of March 14 as the threat of stagflation (i.e., slowing growth & rising inflation) begins to loom large.

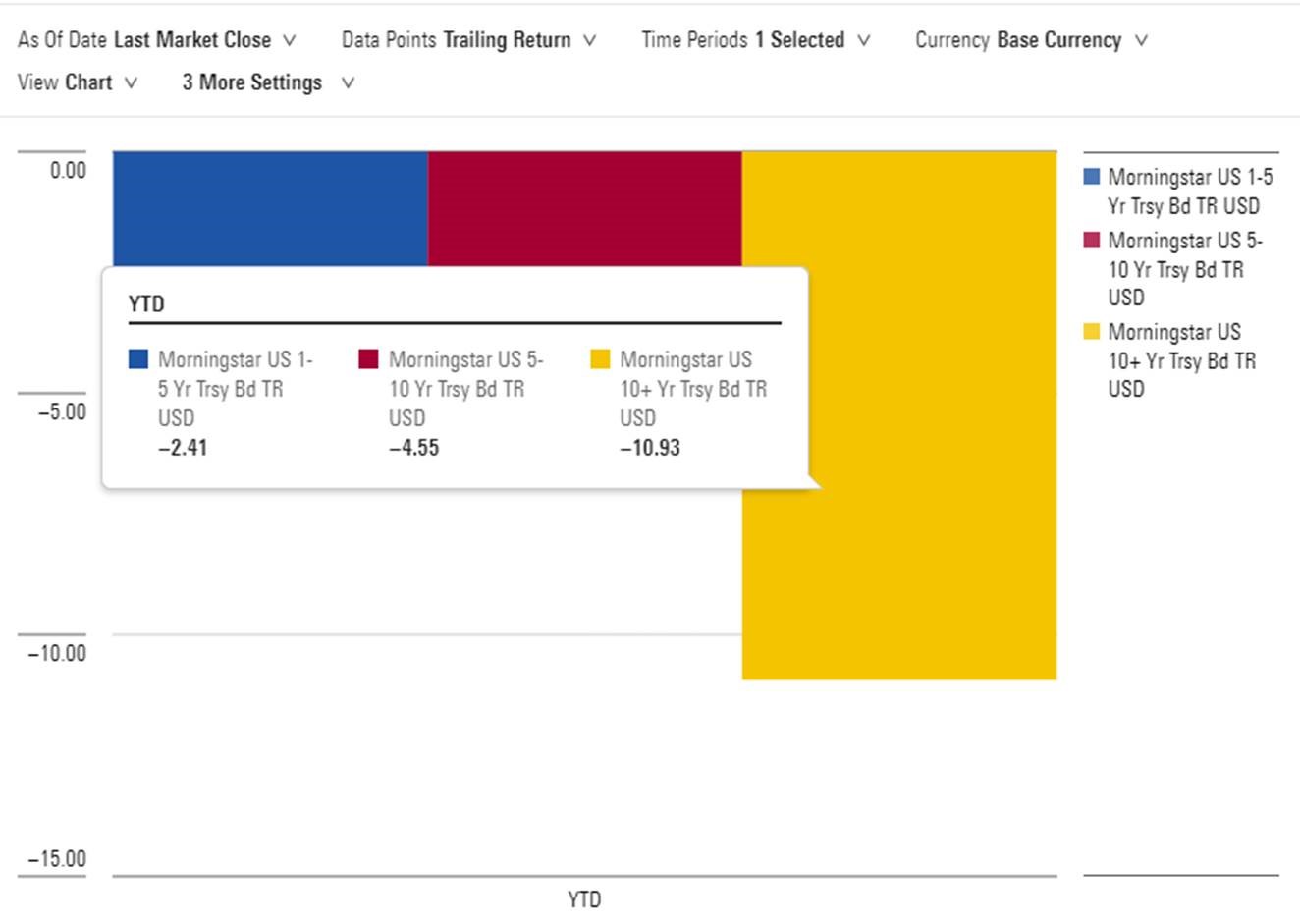

Across the curve, Treasury investors have felt the pain, though investors with exposure to long dated Treasuries have fared the worst, with losses north of 10% YTD, also as of March 14.

Source: Morningstar Indexes. Indexes are not meant for direct investment.

The February CPI reading, released in March, showcased a 7.9% YoY inflation reading – the highest since the early 1980s. Yet oil prices have surpassed more than $100 per barrel in the month of March, making the Fed’s role of trying to cool the economy without creating a recession or stagflationary environment even more difficult.

Katie Binns – Senior Product Manager, Fixed Income & Multi-Asset Indexes, Morningstar:

“The volatility of global markets has been reflected in performance measured across our Morningstar fixed income indexes. While TIPS have performed well in recent weeks, this is a market with very little places to hide for investors. This type of environment underscores the need for investors to be aware of their surroundings, consider being fully diversified and armed with a full set of robust market measures and tools.”

Learn more about our broad range of Fixed Income Indexes. To speak with Katie Binns, contact Tim Benedict at (203) 339-1912 or tim.benedict@morningtar.com.