According to Morningstar’s recently published Global Thematic Funds Landscape 2022 report, thematic investment approaches have exploded in popularity in recent years. Assets under management in thematic funds have more than tripled to $806 billion worldwide in the three years ended December 2021.

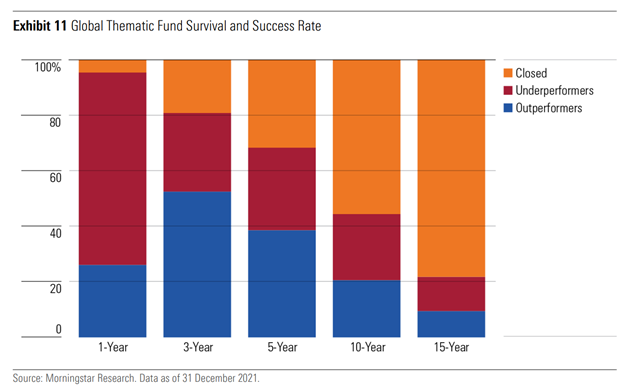

Yet, despite the growing global popularity of thematic strategies, their long-term success rate is less than stellar. While more than half of thematic funds globally outperformed the Morningstar Global Markets Index for the three years ended December 2021, that number dropped to just 39% over the past 5 years and just 10% for the past 15 years.*

According to Ben Johnson, Director of Global ETF Research for Morningstar Research Services LLC, “these figures paint a bleak picture for investors. They suggest that the odds of picking a thematic fund that survives and outperforms global equities over longer periods are firmly stacked against them.”

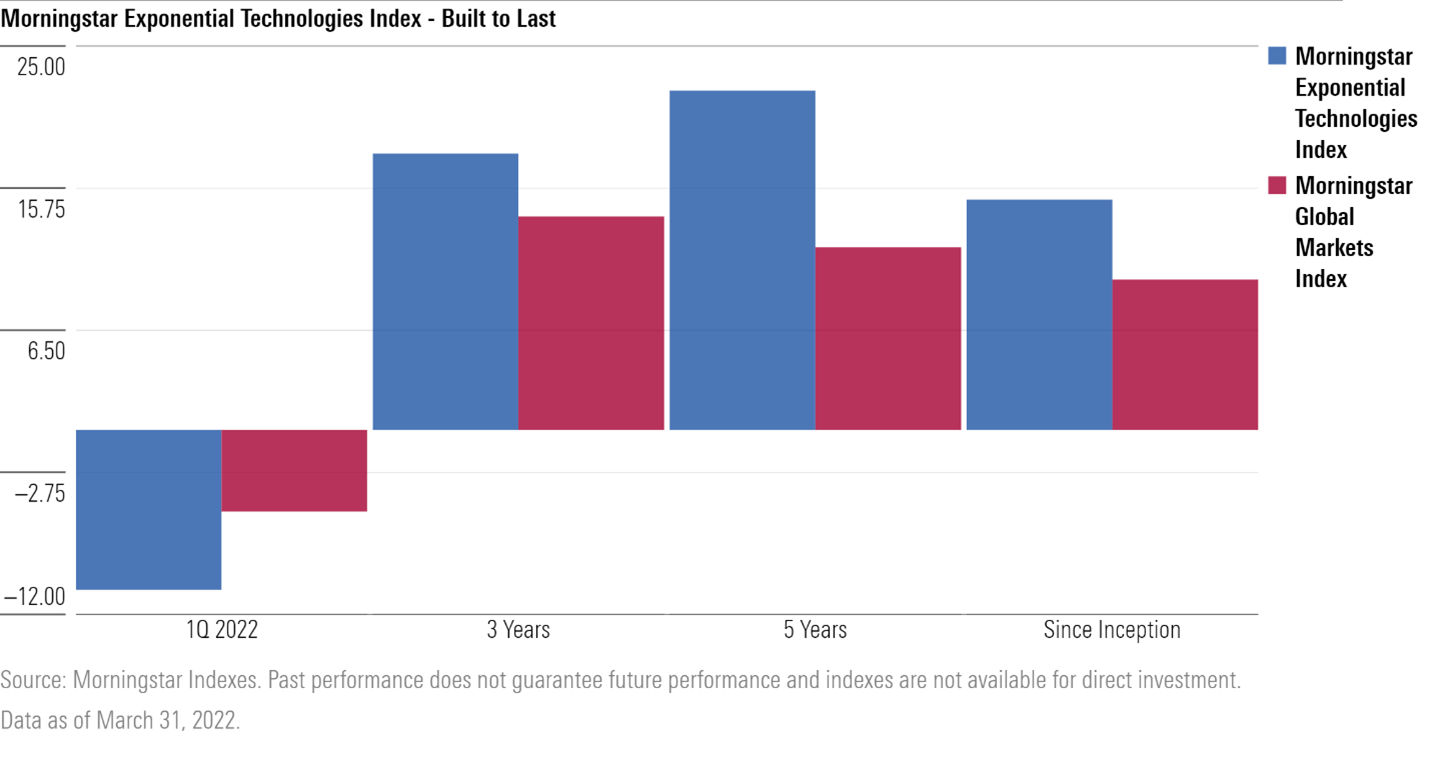

One example of a thematic index approach that has stood the test of time and may provide clues for investors seeking a durable thematic approach is the Morningstar Exponential Technologies Index, launched in 2014. The index is designed to provide exposure to equities positioned to experience meaningful economic benefits as a user or producer of promising technologies. Despite a challenging first quarter which saw the index down nearly 11% amid a broad global market retreat, particularly painful for the technology sector, the index has outperformed its benchmark Morningstar Global Markets Index by 4.2% annually over the past 3 years and more than 10% annually over the past 5 years.

In fact, the index has achieved its track record with a highly favorable 1.04 Sharpe ratio since its 2014 inception. Sharpe ratio is the difference between the index return minus an assumed risk-free rate of return, divided by the standard deviation of index returns, a standard measure for return delivered for each unit of risk.

Morningstar Indexes attributes the strong long-term risk-adjusted return for the index to a methodology based on fundamental research and broad thematic diversification. The index draws on the in-depth research and forward-looking insights of Morningstar Equity Research and its approximately 200 constituents are broadly diversified across nine emerging technology themes.

Rolf Agather – Head of Global Research & Product, Morningstar Indexes:

“Thematic investing is clearly getting investor attention – and assets - in recent years, reinforcing the need for awareness, education and transparency in evaluating thematic approaches. It is very important for investors to understand what they own in their portfolio and to be confident that the theme they are investing in is durable and the companies being included will truly provide exposure to the theme. Ultimately, our research shows that thematic quality and durability relies on the ability to identify companies that will truly benefit from exposure to a theme, as Morningstar does with its equity research driven approach.”

If you have any questions please reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.