Index Insights

Private Equity Market Has Ridden a Wave of Favorable Market Conditions in 2021

New Research from Morningstar Indexes & Pitchbook

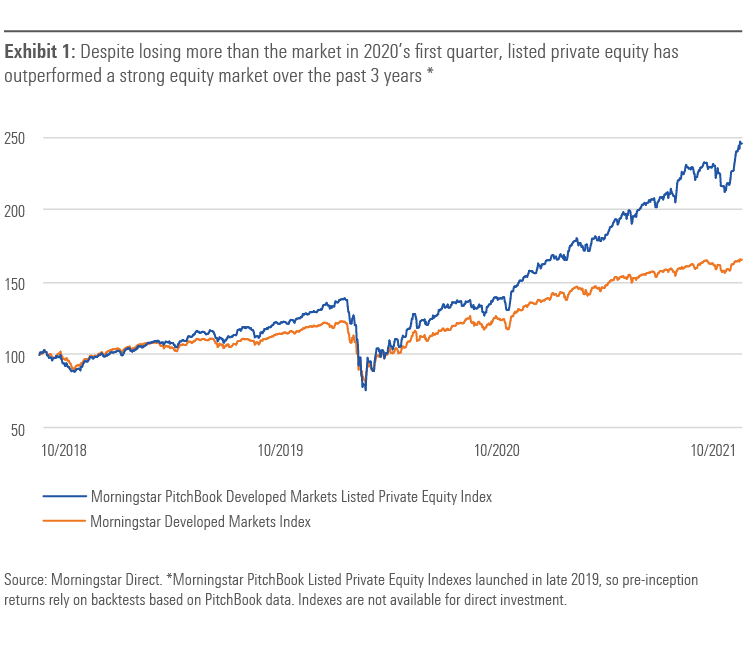

The Morningstar PitchBook Developed Markets Listed Private Equity Index, which measures the performance of public companies with significant private market exposure, has risen nearly 50% year-to-date through the end of October 2021, compared to 20% for its public market index equivalent, according to new research from Morningstar Indexes.

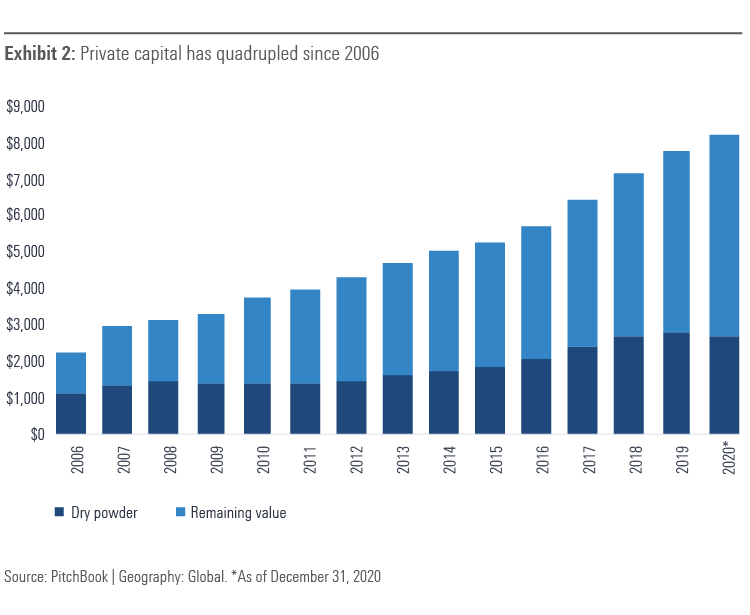

This new report examines the rise of the private markets through the lens of Morningstar Indexes, notably finding that assets in private equity and venture capital funds have quadrupled since 2006 in a period which has seen very favorable conditions for the private markets. In 2021 in particular, the confluence of easy money, market exuberance and stubbornly high fees on sticky and growing asset bases have sent the shares of private equity managers soaring.

But what does this mean for the relationship between public and private equity going forward? While there will inevitably be bumps along the road, the direction of travel is clear. According to Morningstar Indexes and PitchBook, private market investing will endure, and investors may benefit from taking a public-private approach to their own portfolio.

Dan Lefkovitz – Index Strategist, Morningstar:

“To the question of whether the current private market boom is cyclical or secular, the answer is yes. Investors cannot afford to ignore private markets; in the U.S., businesses have raised far more from private markets than public over the past decade and trillions still available for investment. Private market investing has become a portfolio staple for institutional investors and pressure is building to broaden access.”

Andrew Akers, Quantitative Research Analyst, PitchBook:

“Private market investing holds a diversification benefit for investors. Our analysis shows that a 20% allocation to randomly selected private equity buyout funds within a diversified investment portfolio added 0.6% of annualized excess return. A long bull market for public equities and low yields in the bond market have helped build the case for non-correlated assets.”

To speak with Dan Lefkovitz or Andrew Akers, contact Tim Benedict at (203) 339-1912 or tim.benedict@morningstar.com.

©2021 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.