Rising inflation can significantly erode the value of financial assets. Real assets can play an important role in investment portfolios by helping to preserve purchasing power as inflation rises by providing returns that keep up with inflation. Using a diversified basket of real assets offers the best outcome over time. The Morningstar® Real Asset IndexSM can help investors control their exposure to inflation through built-in inflation sensitivity and an attractive risk/return profile.

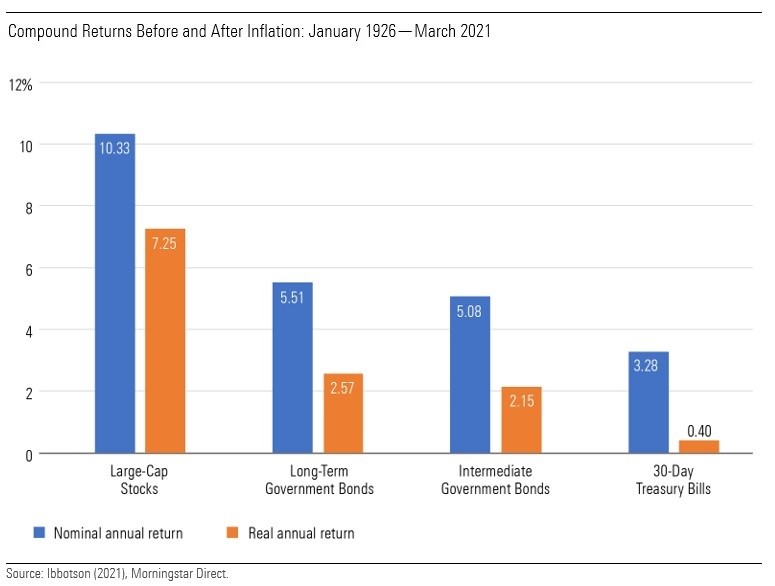

Given the past three decades of declining interest rates and low inflation, it is no surprise if many investors have grown complacent about inflation. But an examination of the compound returns before and after inflation over time show that investors looking to maintain their standard of living may need to consider investments that offer greater potential to outpace inflation.