In a year which has seen unchecked inflation and a notable decline in growth stocks, technology and risk assets, the shares of natural resource-related companies have cut against the grain and risen significantly, according to new insights.

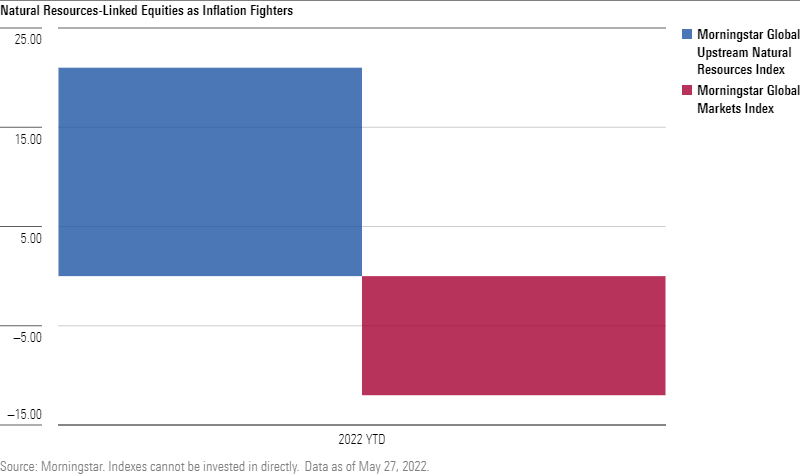

The Morningstar Global Upstream Natural Resources Index, which measures the performance of companies involved in the extraction and production of natural resources across energy, agricultural products, metal, timber and water, has risen more than 21% through the end of May, while the Morningstar Global Markets Index, a broad gauge of developed and emerging markets equities, has declined more than 12% for the same period.

Dan Lefkovitz – Strategist, Morningstar Indexes

“Commodities have historically helped investors diversify during periods of rising inflation. This year, supply/demand imbalances and the Russian invasion of Ukraine have sent commodities prices soaring. While the overall market is down, the Morningstar Global Upstream Natural Resources Index is zigging while growth stocks are zagging.”

Darek Wojnar, Global Head of Funds, ETFs & Managed Accounts, Northern Trust Asset Management

“Oftentimes, asset allocation is thought of as stocks and bonds in some proportion, for example 60/40. But, we encourage investors to be deliberate and consider including real assets, specifically equities focused on natural resources, global listed infrastructure, and global listed real estate. In the case of natural resources, it’s an asset class that is particularly attractive now since, in addition to diversification, it provides inflation protection and helps generate ongoing income.”

If you have any questions or would like to speak with Dan Lefkovitz, please reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.