Dividend-growth investing may provide the opportunity for a smoother ride for US equity investors during a period of heightened market volatility, rising interest rates and runaway inflation. This point is backed by new research based on the Morningstar US Dividend Growth Index.

The index, which tracks US equities with a history of uninterrupted dividend growth, has lost 8.5% in 2022 as of April 30 amid extreme global market volatility which has seen its benchmark Morningstar US Market Index off by 13.9% for the same time period.

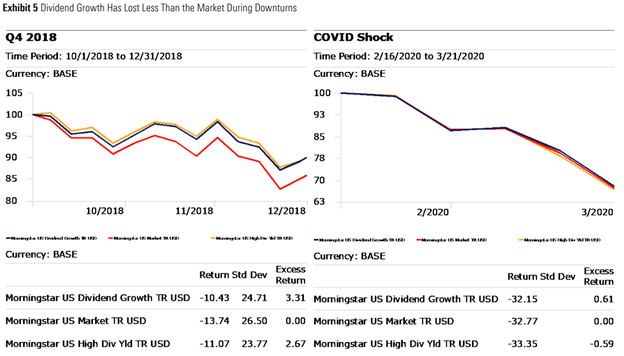

The recent relative performance for dividend-growth stocks is not unusual, according to Morningstar Indexes Strategist Dan Lefkovitz, author of the new report. For the study, Lefkovitz examined relative volatility (as measured by standard deviation of returns, or how much the index varied from its average return) as well as excess return for the Morningstar US Dividend Growth Index and the Morningstar US High Dividend Yield Index relative to the Morningstar US Market Index during two recent periods of heightened market volatility, the fourth quarter of 2018 and the “COVID Shock” of early 2020, illustrating the smoother ride for a dividend-oriented strategy relative to broad markets and higher yielding strategies.

Source: Morningstar Indexes. Past performance is not a guarantee of future results. Indexes cannot be invested in directly.

Dan Lefkovitz - Strategist, Morningstar Indexes:

“Volatile markets can offer investors an opportunity to re-examine traditional investment approaches. Companies with the capacity to grow their dividend over time, for example, tend to be more durable and capable of passing along rising prices. These types of companies can currently be found in the financial services, industrial and healthcare sectors.”

If you have any questions or would like to speak with Dan Lefkovitz, please reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.