Index Insights

Canadian Investors Missing a Trick

The Canada Multi-Asset Effect

May 27, 2021 – Canadian investors ignore bonds and global equities at their own peril, according to new Canada market research from Morningstar Indexes.

The new report, authored by Morningstar Index Strategist Dan Lefkovitz, examines Canada asset class behavior through the lens of six Morningstar Indexes measuring performance of equity and fixed income markets within Canada and globally.

Dan Lefkovitz – Strategist, Morningstar Indexes

“Morningstar index analysis across Canada and global equity and fixed income markets clearly points to the benefits for Canadian investors of looking across asset classes as well as across borders. Spreading one’s bets is typically a good strategy, particularly in Canada due to its relatively narrow sector representation and small percentage of global market capitalization.”

Key Findings:

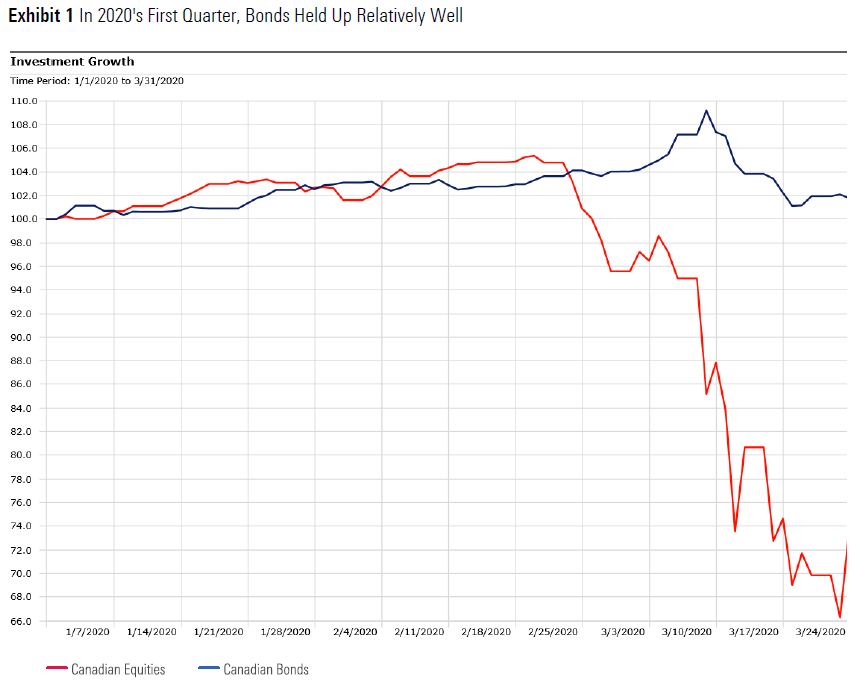

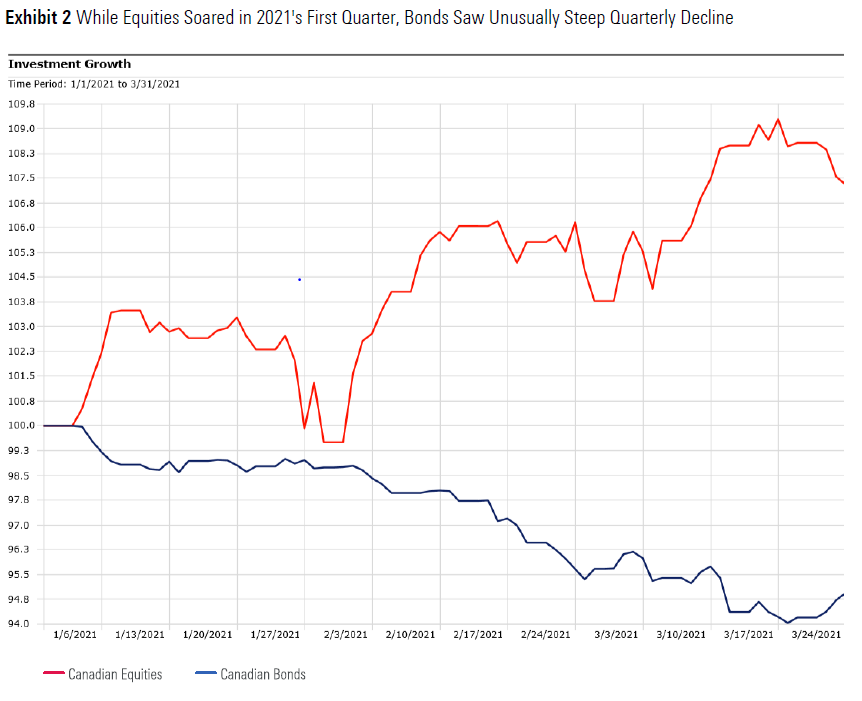

Canada Bonds Shine in Times of Crisis. A comparison of performance for the Morningstar Canada Core Bond Index and Morningstar Canada Domestic Index in 2020 and 2021 as the global markets rode the ups and downs of the Global Pandemic illustrate the potential value of fixed income diversification. In the first quarter 2020, fixed income assets were a relative safe haven for Canadian investors relative to equities; a year later the picture was reversed with equities outperforming bonds by a wide margin.

While past performance is not a guarantee of future results, bonds also gained in 2018, when Canadian equities declined, and they cushioned losses in a series of equity market crashes over the last 25 years using Morningstar mutual fund category averages, showing Canadian fixed income assets have the potential to serve as effective flights to safety as stocks sell off.

Source: Morningstar Direct. Data as of March 31, 2020. Canadian equities represented by the Morningstar Canada Domestic Index GR CAD and Canadian bonds by the Morningstar Core Bond Index GR CAD. Indexes are not available for direct investment.

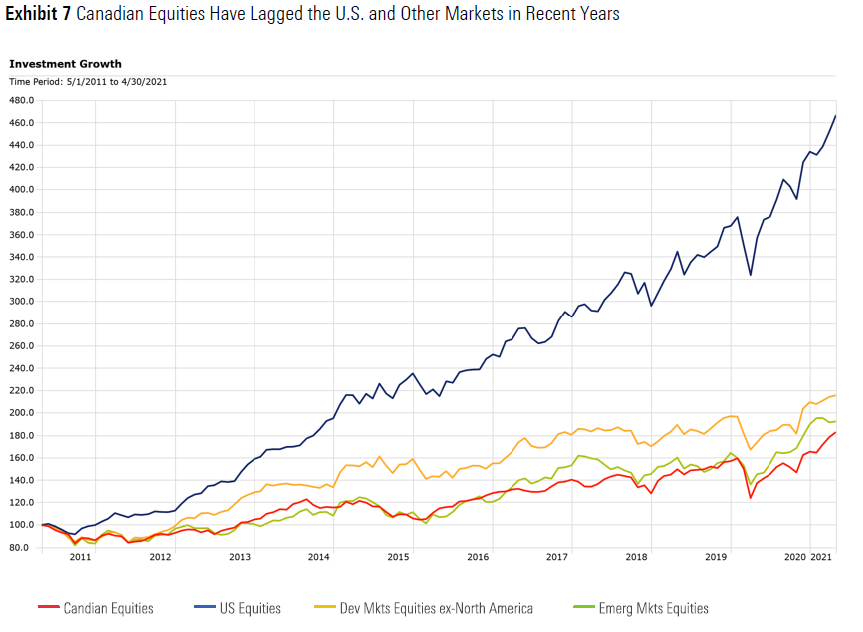

Home Country Bias is a Drag for Canada Equity Investors. Canadian equity investors with significant home country bias have missed out on substantial market gains over the past decade, particularly in U.S. equities, as shown by a comparison of the Morningstar Canada Domestic Index, Morningstar US Target Market Exposure Index, Morningstar Developed Markets ex-North America Target Market Exposure Index and the Morningstar Emerging Markets Target Market Exposure Index.

Source: Morningstar Direct. Indexes Displayed: Morningstar Canada Domestic GR CAD, Morningstar U.S. Target Market Exposure Index NR CAD, Morningstar Developed Markets ex-North America Target Market Exposure Index NR CAD, Morningstar Emerging Markets Target Market Exposure Index NR CAD. Indexes are not available for direct investment.

Media requests to speak with Dan Lefkovitz, please contact Tim Benedict at (203) 339-1912 or tim.benedict@morningstar.com.

©2021 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.