Index Insights

A September (Not) to Remember for US Large Cap Growth

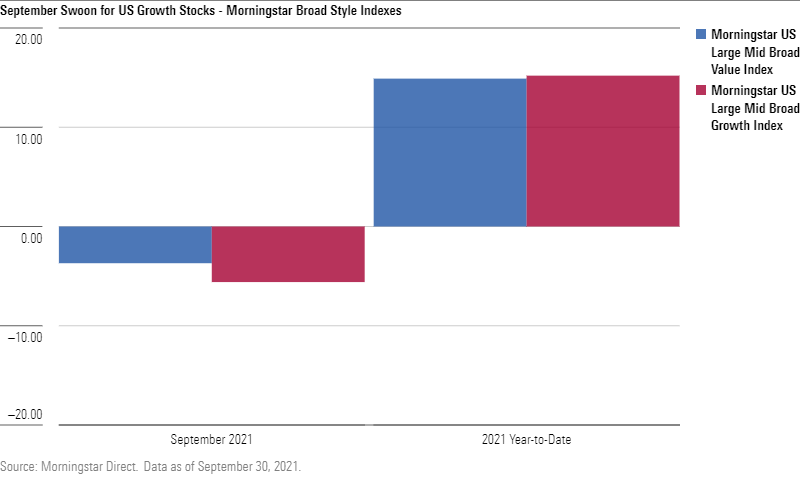

The Morningstar US Large-Mid Broad Growth Index fell 5.9% in September amid a turbulent month for US equity markets. Overall, growth stocks are leading value stocks for the first three quarters of the year, but small cap value is the best performing corner of the market in 2021.

High-tech large-cap companies, which currently hold top weightings in Morningstar’s broad growth index led the US equity market down in September, with Microsoft (-6.6% vs. +27.5% year-to-date), Facebook (-10.5% vs. +24.3% year-to-date) and Alphabet (-7.6% vs. +52.5% year-to-date) all experiencing a reversal in September stock performance.

Small-cap value stocks are still on top for 2021, with the Morningstar US Small Cap Broad Value Extended Index up 23% year-to-date through September 30.

Dan Lefkovitz – Strategist, Morningstar Indexes:

“The Morningstar® Broad Style Indexes℠ were designed in alignment with the Morningstar Style Box™ as a more intuitive and flexible representation of the constantly evolving style and size dimensions of the U.S. equity market. And it has certainly been exciting to watch the push and pull between growth and value dynamics through the lens of these indexes, with growth taking a big hit in September. And let’s not forget small cap value, which has continued to ride a wave from significant outperformance in the first quarter, with strong contributions from the Financial Services, Energy and Consumer Cyclical sectors.”

Bob Hum, US Head of Factors ETFs for BlackRock:

“With COVID-19 cases falling from their highs in August, we’ve seen a shift in sentiment back towards cyclical “Reopening Winners”, or value stocks that have benefited from the reopening of the economy (airlines, cruises, etc.) We believe this constant reversal between value and growth/defensive exposures has led many investors to hedge their bets by barbelling Value and more defensive oriented quality exposures.”

For a deeper look at recent style investing trends through the lens of the Morningstar Style Box and Morningstar Broad Style Indexes, check out Lauren Solberg’s most recent markets blog on Morningstar.com. To speak with Dan Lefkovitz, please contact Tim Benedict at (203) 339-1912 or tim.benedict@morningstar.com.

©2021 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.