Markets are getting more global, not more local, when it comes to source of revenue, according to the new GeoRevenue Atlas.

Contrary to popular opinion, globalization is not dead when it comes to sources of company revenue, according to new research. For the most recent annual update of the GeoRevenue Atlas, we studied geographic revenue data for 48 national equity indexes, which represent 97% of global equity market capitalization and are comprised of the 8,385 of the constituents within the Morningstar Global Markets Index.

Notable findings include:

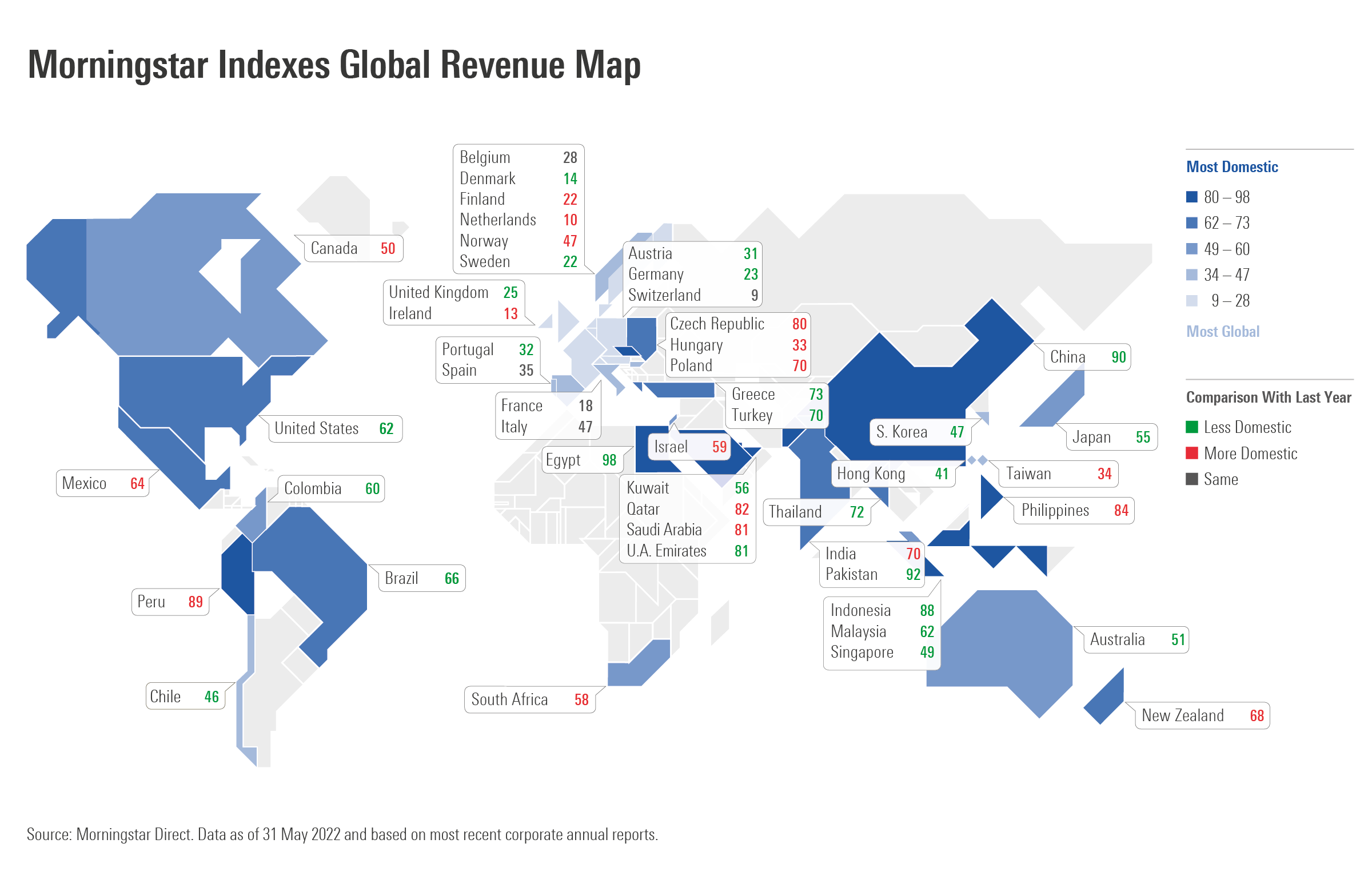

- As displayed on the Morningstar Indexes Global Revenue Map, corporate filings show 25 countries actually grew the share of revenue sourced outside their home market, compared with the June 2021 study, and 18 countries became more domestic.

- Despite predictions that global supply chain issues would reverse or slow globalization, domestic revenue for constituents within the Morningstar US Market Index decreased slightly from the June 2021 study.

- Globalized revenue streams continue to be the norm for developed markets. Japan, the UK and China, for example, all generated more revenue internationally than in the past.

- Looking at markets in the Asia Pacific region, Japan, South Korea, China, Hong Kong and Australia all became less domestic in the last year in terms of company revenue sources.

Dan Lefkovitz – Strategist, Morningstar Indexes

“Looking at Morningstar’s national equity market indexes through the lens of geographic revenue exposure underscores the benefits of investing globally. Leading companies operating in an investor’s home market may be domiciled somewhere else. As shown during the pandemic, markets and economies can diverge meaningfully. Meanwhile, contrary to popular perception, company revenue data shows that globalization is alive and well.”

Dan Lefkovitz shares more insights on this topic in a recent article – This July Fourth, the U.S. Equity Market Looks a Little Less Star-Spangled.

If you have any questions about the new GeoRevenue Atlas or to speak with Dan Lefkovitz, please contact Tim Benedict at (203) 339-1912 or tim.benedict@morningstar.com.