As originally published on Morningstar.com.

With assets in sustainable funds down in the US and relatively flat in the rest of the world, some commentators have declared that “ESG is dead,” referring to the environmental, social, and governance approaches commonly used in sustainable investing. Reality, of course, is more complex than this narrative suggests. This is illustrated by recent interviews conducted for Morningstar’s fourth annual Voice of the Asset Owner survey.

Institutional asset owners, referred to here as AOs, are the world’s most powerful and influential investors, with a long time horizon grounded in fiduciary duty. They encompass pension funds, sovereign wealth funds, insurance companies, foundations, and endowments, among others. Pension funds alone controlled more than $58 trillion in assets in 2024, according to WTW Thinking Ahead Institute. Asset owners are at the front end of the investment value chain, helping set the agenda for investment consultants, asset managers, and other intermediaries, and they’ve been instrumental in the development of sustainable investment over the past 25 years. They have been the beating heart of sustainable investing.

The VOAO survey is designed to glean insights into what makes AOs tick and how they implement ESG policies into their investments. The survey consists of two parts: a qualitative phase using scripted interviews with a select group of AOs, followed by a quantitative questionnaire sent to hundreds of global AOs. The qualitative interviews inform the evolution of the quantitative survey, which provides a global perspective on the beliefs and behavior of AOs. (For last year’s survey, read this.)

This year, for the qualitative phase, Morningstar Indexes and Sustainalytics, in conjunction with survey partner Opinium, interviewed 25 AOs from across the globe. The interviews provide a nuanced perspective on ESG and sustainable-investment practices through an AO lens: investment beliefs, priorities and practices, and insights into implementation.

Some of my key takeaways from reading their responses: Climate remains a top priority, the future of the label ESG is an open question, organizations such as Glasgow Financial Alliance for Net Zero must adapt to remain relevant, sustainable investors will be a more important voice for urgent action on policy, and AOs increasingly use underlying data rather than aggregated ESG ratings.

What’s on the Minds of Asset Owners?

Several themes emerged from our conversations.

Macro instability and market volatility. We conducted the interviews in early April, shortly after the Donald Trump administration announced across-the-board tariffs on global trading partners. Asset owner responses reflected the extreme macroeconomic uncertainty and market volatility that ensued. The macroeconomic environment is always framed by global events—like the Russian invasion of Ukraine in 2022, inflation and interest rates in 2023, and the Israel-Hamas war in Gaza in 2024. But this year, there was palpable concern that the global economy is entering a period of fundamental transformation with highly uncertain outcomes.

ESG headwinds. Some of the critiques of ESG approaches in the US have been by politicians who regard it as “woke investing,” and some people argue the term is so overly politicized that it should be replaced. Some asset owners leaned toward replacing it with “sustainability” or “sustainable investment,” while others opined that they’d be fine with no label if ESG analysis was just considered a standard part of analysis. But they are generally not distracted by labels, preferring instead to focus on the substance of issues that affect systemic risk—such as climate change—because their practices are framed by their mission, fiduciary role, and long time horizon.

Some asset owners noted that attacks on ESG in the US have made their jobs more difficult, citing the challenge of standing by their convictions and executing as fiduciaries without attracting unwanted attention in a hostile political environment. One UK asset owner said: “It’s very important that asset owners maintain consistency and persistence as forms of dilution might have happened from asset managers because they’re under political attack.”

Regulatory uncertainty. Asset owners’ views on regulation are evolving. In the recent interviews, AOs expressed the need for a balance between regulation- and market-based standards. In past years, VOAO respondents broadly favored EU regulation on corporate disclosure on sustainability issues, expecting it would bring rigor and consistency to the data. Last year, concerns about the complexity and cost of regulations were voiced. The simplification and reduced scope of regulation in the EU “Omnibus” proposal is seen as a step forward by some and a step backward by others. But most view the uncertainty introduced by the changes as problematic as regulators fine-tune corporate disclosure of ESG data.

Climate remains a top priority. This year’s qualitative survey reinforced the continued priority of AOs on climate risk and transition readiness. Over the past decade, climate strategies have primarily been oriented around portfolio decarbonization and/or investments in climate solutions such as renewable energy, green infrastructure, and electric vehicles. Portfolio decarbonization considers carbon exposure as an investment risk, which it seeks to lower by reducing holdings in carbon-intensive companies. But many of the AOs we interviewed indicated that their emphasis has shifted to using their leverage to hasten decarbonization of the real economy. By engaging with investee companies, they seek a more direct transmission mechanism for moving the economy through its energy transition.

Private markets. Asset owners are applying ESG analysis to a growing range of asset classes, including private markets (equity and credit). AOs are always looking for enhanced returns and uncorrelated asset classes. Private market investments are not new, but they are an increasing part of AOs’ asset allocations. Private markets offer investors the opportunity to put more capital to work in their home countries. They observed that the quality of ESG data varies across asset classes, noting the value of total portfolio coverage despite this limitation.

One Australian AO noted: “Where we’re starting to put more money to work is private credit…In the last 12 months, we’ve started to look for opportunities in the private equity space and that would continue.” Meanwhile, a UK AO observed, “One of the areas we’ve always struggled with is around getting data for private markets companies.”

Looking at the Future of Sustainable Investment

ESG investment is in transition, confronted by political polarization, regulatory uncertainty, and disruption of global trade.

Some high-profile banks, insurance companies, and corporations have pulled back on their sustainability commitments, usually around climate or DEI, or have left organizations dedicated to advancing such initiatives. Is this a pragmatic response to a difficult situation or an off-ramp from commitments made without much conviction?

Collaborative organizations like GFANZ and Climate Action 100+ have been crucial catalysts for investors seeking action to address climate change. What role will they play going forward?

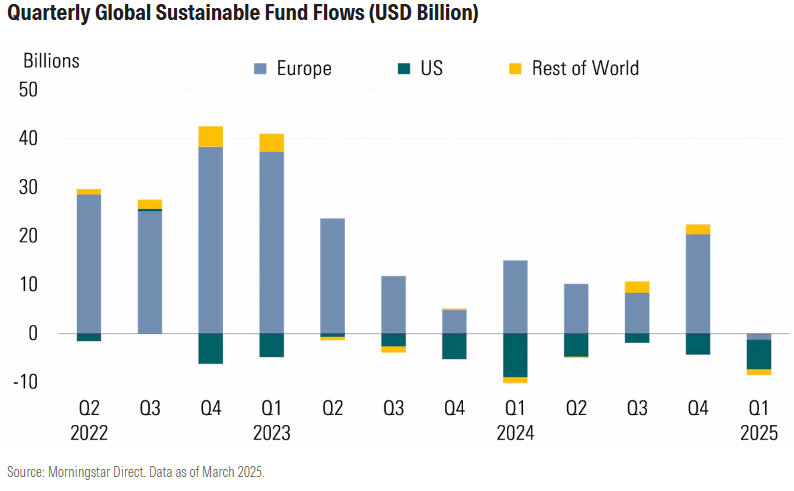

Morningstar research shows that, in the first quarter of 2025, US sustainable funds (10% of global assets under management) had outflows for a 10th consecutive quarter. Europe (84% of global AUM) experienced its first quarter of net outflows since Morningstar started tracking sustainable funds in 2018. Global AUM fell to $3.16 trillion, marginally below its historic high of $3.18 trillion in third-quarter 2024.

It’s clear that US investors have soured on sustainable funds following political attacks on ESG beginning in 2022. Whether this negative sentiment is transitory or long-term remains to be seen.

We appear to be experiencing a bifurcation between retail and institutional segments in sustainable investment. Are we entering a transition period that sets the stage for a renewed growth in sustainable-investment options for wealth and retail investors?

- New investment practices are incubated in the institutional realm before becoming accessible to wealth and retail investors. In the coming years, we can expect to see significant changes in the sustainable-investment landscape. The term “ESG” was created in the early 2000s to describe material factors not captured in traditional financial analysis. Properly understood, it is an analytical framework, not an investment objective. Demonized by politicians in the US, how the label fares in the future is an open question. Either way, it’s vital to keep these issues on the agenda for investors.

- In response to changing geopolitical risks, European investors are reevaluating the long-standing screen on weapons manufacturers. Consensus on this matter will be elusive. But it’s indicative of how sustainable investors must be open to reevaluating policies in a changing world. It’s unrealistic to expect everyone will always agree on everything, so resilience is necessary to navigate these dynamics.

- Sustainable investors created organizations like the GFANZ and CA100+ to amplify their voices for collaborative engagement, standard setting, and the like. Challenged on anticompetitive grounds in the US, some members have left. These organizations must adapt to the new reality to remain fit-for-purpose.

- More effective public policy is essential for addressing systemic risks like climate change. Sustainable investors will be vocal advocates for urgent action on policy. It took more than 70 years to develop today’s global accounting standards, but today we don’t have the luxury of time.

- Asset owners we interviewed said they increasingly use underlying data rather than aggregated ESG ratings. Ratings will continue to play a role, but service providers need to tailor solutions to their clients’ particular asset allocations, investment processes, and workflows. This includes leaning into technology, including artificial intelligence, which will play a more prominent role in gathering and analyzing data, to expedite progress toward more-salient sustainable-investment analysis.

These developments are already underway for institutional investors. They should hasten the evolution of sustainable investment to meet the needs of asset owners and, as a result, a more compelling investment strategy for retail and wealth investors. Indications from the VOAO qualitative survey suggest that the convictions of institutional investors about ESG remain strong.

Keep an eye out for results of the full VOAO survey in September to learn more about where ESG and sustainable investment are headed.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.