The Morningstar US Dividend and Buyback Index is undergoing several changes in December 2022:

- Index stock selection will place a 75% weight on dividends and 25% on buybacks—moving away from absolute shareholder yield as the criteria.

- To increase yield, the index will target the highest yielding stocks representing 50% of the broad equity market’s total shareholder distributions, down from 90%.

- Stocks with dividend yields in the top 5% of the market will be excluded.

- Sector weights will be constrained to within 5 percentage points of market weight.

The goals of the methodology changes are two-pronged. First, the index’s dividend yield should increase, with an eye toward avoiding unsustainable payouts. Second, index composition and behavior should be closer to the overall equity market than a traditional high-yield strategy.

Why Consider both Dividends and Buybacks in the First Place?

The Morningstar US Dividend and Buyback Index was launched in 2017 to recognize a fundamental shift in equity market dynamics. Recent decades have seen more and more companies repurchase their own shares, rivaling dividends as a means of returning cash to shareholders. Although the US equity market’s aggregate dividend yield is well down from its historical range of 3%-6%, regular cash payouts to shareholders are far from dead. Many investors still treasure dividends, and as a result are more likely to ride out price fluctuations. For corporate managers, the dividend commitment instills discipline. Screening for dividend payers is also a means of weeding out speculative stocks.

But share repurchases are popular for a reason. Relative to dividends, they offer a company flexibility. Whereas the market punishes dividend cuts, buybacks can be conducted when there’s excess cash on hand or managers and directors believe shares are undervalued. Buybacks can be beneficial for investors too, as repurchases give existing holders a larger ownership stake.

While dividends and buybacks are sometimes pitted against each other, it’s really a false dichotomy. Many companies engage in both. To get a true sense of total shareholder yield, it’s useful to consider dividends and buybacks together.

Indexing for Both Income and Total Return

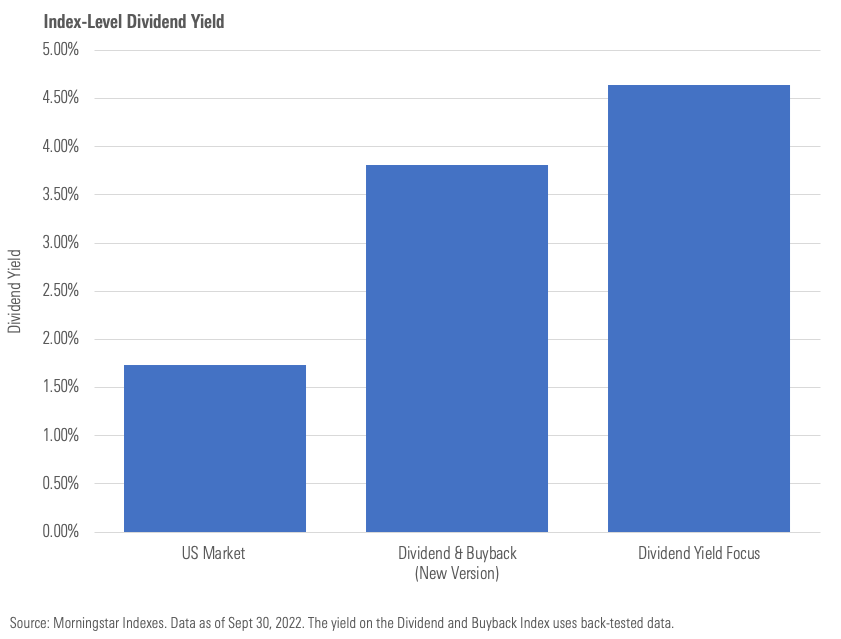

After the December 2022 methodology change takes effect, the Morningstar US Dividend and Buyback Index will continue to include companies that return cash to shareholders in the form of both dividends and buybacks, but the increased weight to dividends and the higher selection threshold should boost index-level yield. The new methodology produced a hypothetical index-level yield of 3.8% as of September 30, 2022, versus 2.5% for the old version. As seen in Exhibit 1 below, that’s well above that of the broad market, thought short of the Morningstar Dividend Yield Focus Index, which represents a high-income approach.

Exhibit 1: The Dividend & Buyback Index's Yields More than the Market but Less Than a High Equity Income Approach

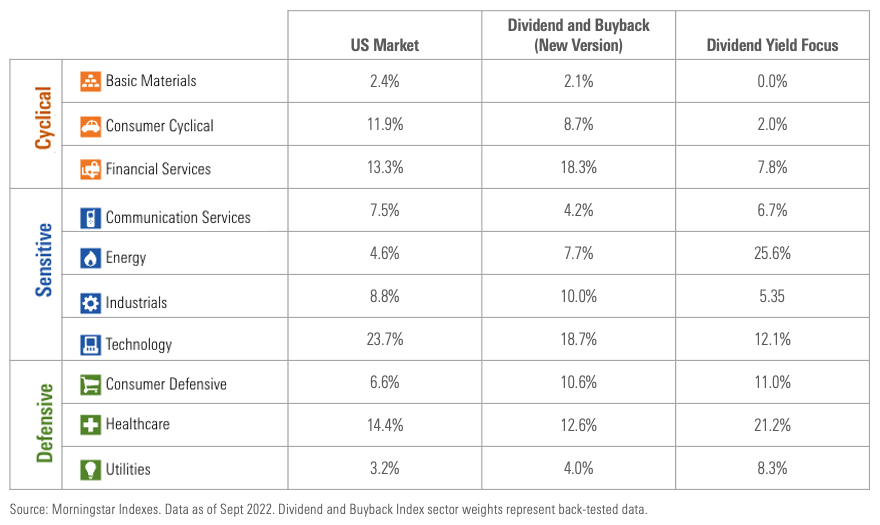

Other methodology changes, such as sector constraints, will assure that the Dividend and Buyback Index does not stray too far from market. Consider the sector weights in Exhibit 2 below. In areas like technology, energy, and healthcare, the Dividend and Buyback Index is closer to the broad equity market than the more value-leaning high-income Dividend Yield Focus Index.

Exhibit 2: The Dividend & Buyback Index's Sector Weights are Closer to the Market Than a High Equity Income Approach

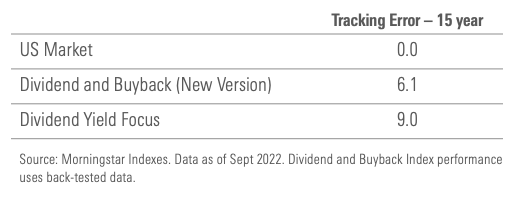

Looking more like the broad equity market should limit performance deviation. Indeed, over the back-test period, the new version of the Dividend and Buyback Index did not stray as much from the Morningstar US Market Index as the Dividend Yield Focus Index (measured by tracking error as displayed in Exhibit 3 below), though it did provide distinctive exposure.

Exhibit 3: The Dividend & Buyback Index Deviates from the Market but Not to the Same Degree as a High Equity Income Approach

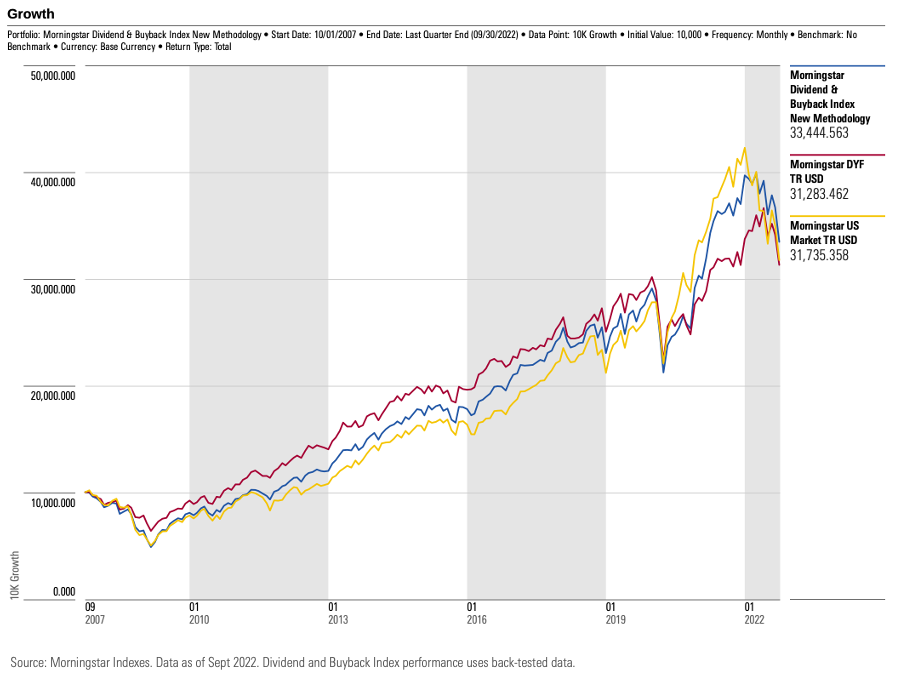

Unsurprisingly, when the new version of the Dividend and Buyback Index’s simulated returns are displayed in relation to the Morningstar US Market Index and the Dividend Yield Focus Index, it is often positioned in the middle, as seen in Exhibit 4 below.

Exhibit 4: The Dividend & Buyback Index Tends to Outperform a High Equity Income Approach When Dividends are Out of Favor but Underperform the Market When Growth Stocks are Leading

In the early years of the back-test period, when dividend-paying stocks were leading, the index lagged, but it outperformed the broad equity market. In 2020-2021, when dividend-light stocks in tech-related sectors were on top, it fell behind the market but did not trail by as much as Dividend Yield Focus.

Beyond Yield

Dividend yield alone does not paint the full picture of any investment. The Morningstar US Dividend and Buyback Index represents a more complete view of shareholder distributions by considering both repurchases and dividends. The methodology enhancements of December 2022 should boost index-level yield, while mitigating exposure to yield traps. Sector constraints should limit performance deviation from the market. The index is designed for investors focused on both income and total return.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.