The Takeaway

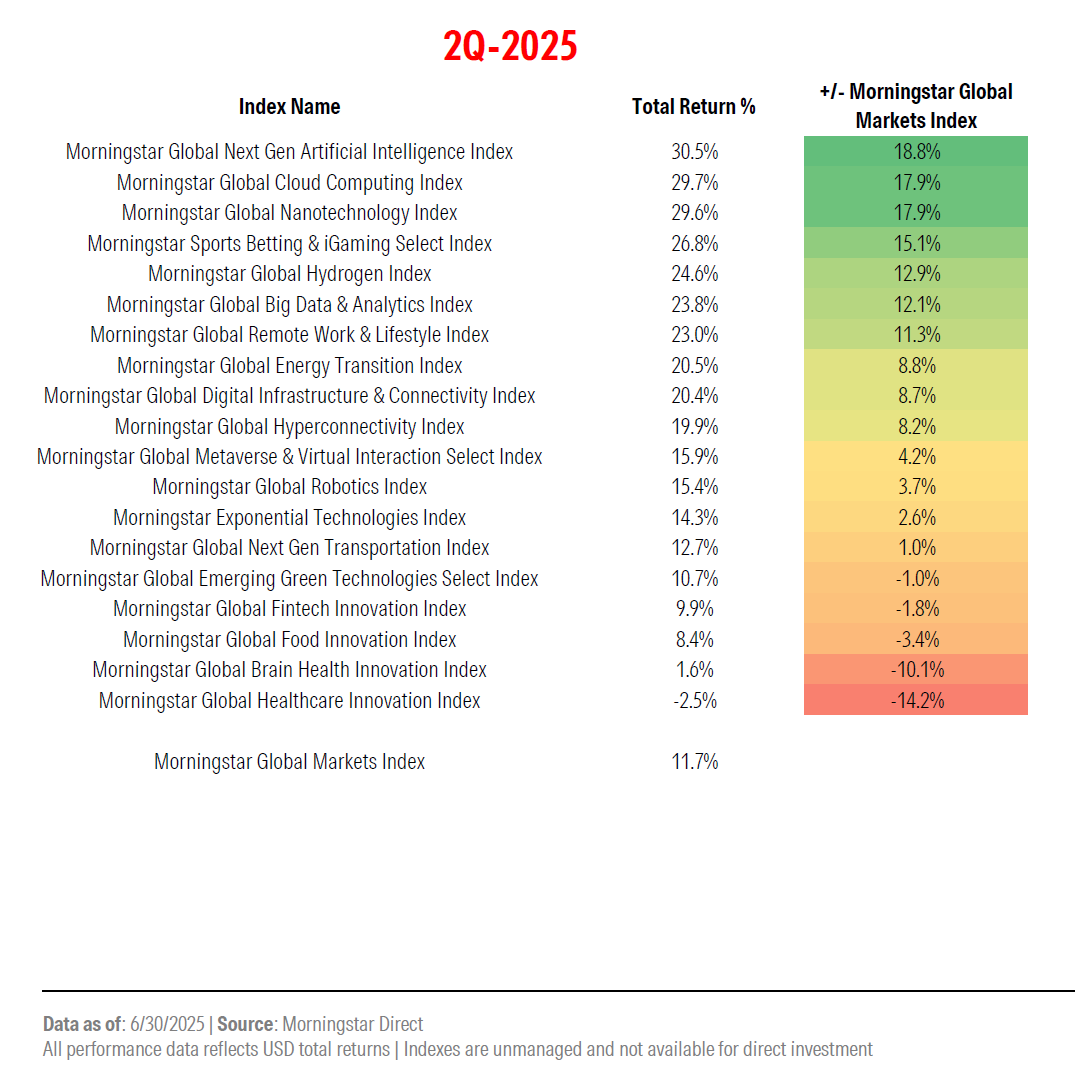

Best Performing Themes: Next Generation Artificial Intelligence, Cloud Computing, Nanotechnology.

Worst Performing Themes: Healthcare Innovation, Brain Health Innovation, Food Innovation.

With growth having soundly outperformed value, thematic indexes highly exposed to growth stocks tended to perform well.

Despite escalating trade frictions and heightened geopolitical tensions, the Morningstar Global Markets Index posted an impressive 11.7% total return in the second quarter. In the quarter, market conditions echoed those witnessed during the 2023 and 2024 calendar years, with growth soundly outperforming value and the "Magnificent 7" stocks driving a healthy portion of broad market returns.

Leveraging forward-looking insights from Morningstar equity analysts, Morningstar Thematic Indexes are designed to deliver unparalleled thematic purity across a range of durable themes. Across Morningstar's thematic index lineup, the three top-performing indexes in the second quarter focused on the Next Generation Artificial Intelligence, Cloud Computing, and Nanotechnology themes, with each of these indexes exhibiting a growth bias relative to the Morningstar Global Markets Index. Within this group, the Morningstar Next Generation Artificial Intelligence Index performed best, delivering a 30.5% total return and outperforming the Morningstar Global Markets Index by 18.8%. Meanwhile, the three worst-performing thematic indexes focused on the Healthcare Innovation, Brain Health Innovation, and Food Innovation themes. Within this group, the Morningstar Global Healthcare Innovation Index performed worst, generating a -1.1% total return and underperforming the Morningstar Global Markets Index by 17.4%.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.