The Takeaway

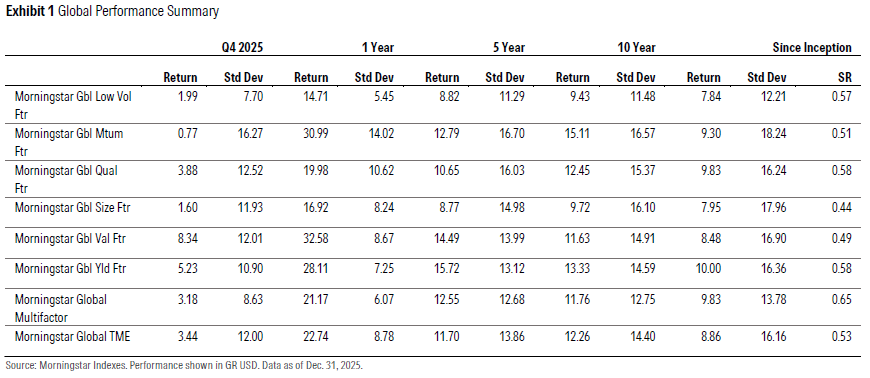

Factor leadership rotated sharply from the third quarter: Value led globally in the fourth quarter, while momentum lagged. Value, yield, and quality improved their relative standing, whereas low volatility and size stayed in the bottom half.

Factor performance rankings were broadly consistent across regions, except in developed markets ex-US, where quality again ranked as the weakest factor for the quarter.

Factors are complementary and offer strong diversification benefits when combined in a portfolio.

In a sharp reversal from the third quarter, momentum was the worst-performing factor globally in the fourth quarter, while value topped the rankings. The shift underscores how quickly leadership can rotate when markets move away from “trend-following” conditions. With the exception of the second quarter—when value ranked second to last—value placed in the top three for most of the year and finished 2025 as the best-performing factor, followed by momentum and yield.

The unusually strong positive correlation between value and momentum observed during the third quarter did not persist in the fourth quarter consistent with the expectation that their market-relative performance tends to be negatively correlated. For the full year, momentum's strong outperformance (21.6% return) over value (6.9% return) in the second quarter pushed it to the top of the rankings along with value, suggesting that the third-quarter co-movement should not be viewed as representative across all quarters of the year.

The Morningstar Global Value Factor Index posted strong performance, backed by strong intrasector stock exposure, particularly within the technology, communication-services, financial-services, and industrials sectors. Key contributors included overweight positions in Alphabet Class A, Micron Technology, and SK Hynix, alongside underweightings in Microsoft and Meta. In effect, the value portfolio benefited less from broad sector positioning and more from being differentiated within sectors—capturing relative winners and avoiding laggards while remaining close to benchmark sector weights.

The Morningstar Global Momentum Factor Index was hindered by stock selection within communication services and technology, including an overweight position in Netflix and an underweight position in Alphabet.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.