The Takeaway

A range of factors has conspired to boost dividend paying stocks in 2022. It’s not just about dividend indexes’ exposure to the dominant energy sector.

The outperformance of dividend payers in 2022 is no fluke. Going back through history, there have been plenty of periods like 2004-2006, when rates rose but dividend stocks dramatically outperformed growth stocks. The broader context is critical to understand.

Across global markets, the link between rates and dividends is inconclusive, leading to the conclusion that equity income investors should focus more on fundamental factors like dividend durability and less on macroeconomic ones like interest rates.

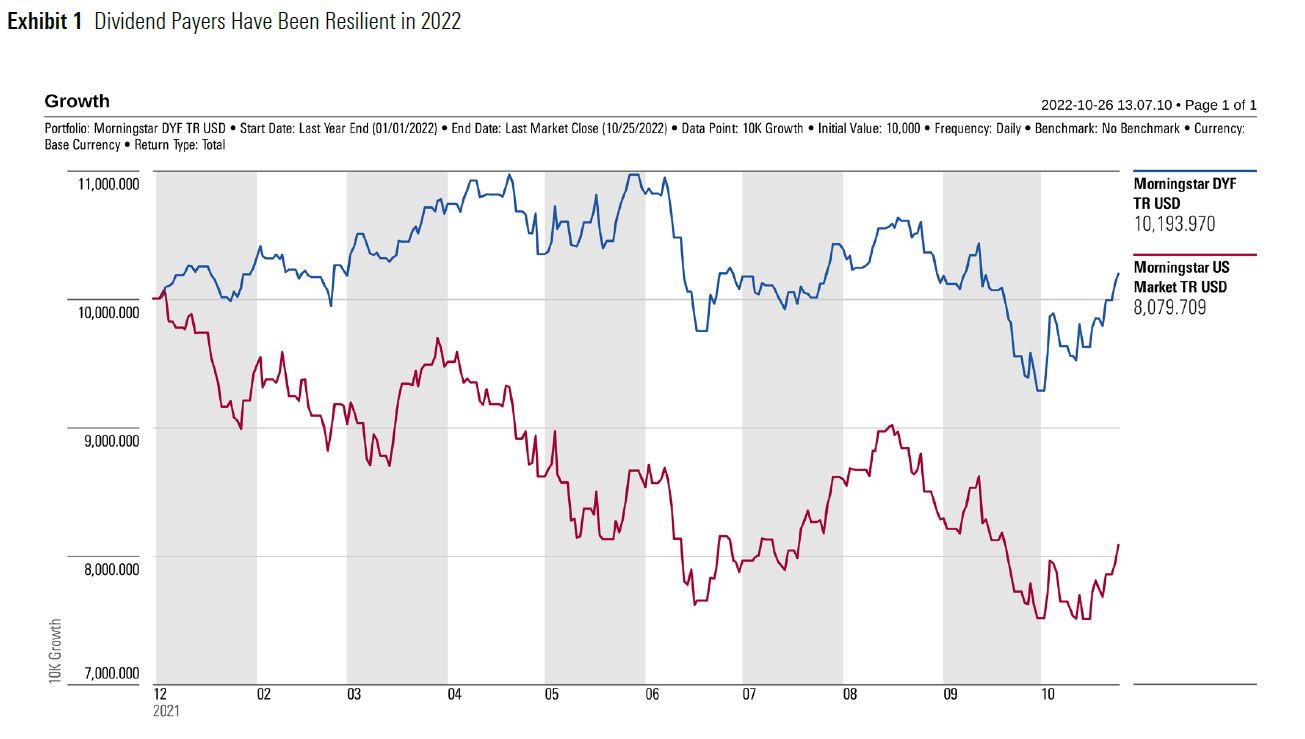

It’s commonly believed that rising interest rates are bad for dividend-paying stocks. Higher rates, the thinking goes, diminishes the appeal of equity income relative to fixed income while raising the debt-servicing burden for leveraged companies. Well, the US Federal Reserve and central banks around the globe have aggressively hiked interest rates in 2022. Yields on bonds and bank deposits have soared. Yet dividend paying stocks have dramatically outperformed the market. Both the Morningstar Dividend Yield Focus Index and the Morningstar Dividend Leaders Index are in positive territory while the broad equity market is down roughly 20%. Now, we are told that rising rates are bad for growth stocks because higher interest rates devalue their long-dated earnings. Meanwhile, stocks and bonds have simultaneously swooned, making us question everything we thought we understood about markets. What on earth is going on?

This paper uses Morningstar dividend indexes to explore the relationship between equity income and interest rates. It looks at the dynamics that have led to dividend-stock outperformance in 2022 but also examines the historical record. Is 2022 anomalous or have dividend payers weathered other rising rate cycles? Is the US exceptional, or has the link between interest rates and equity income held steady in Europe, Japan, and Australia? Just how much attention should equity income investors be paying to interest rates and the macroeconomic backdrop?

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.