The Takeaway

The Morningstar US High Dividend Yield Index's underperformance over the past 18 months could be attributed to higher interest rates. That said, dividend-payers were resilient amid rising rates in 2022, and the Morningstar Global ex-US High Dividend Yield Index has outperformed in a rising interest-rate environment.

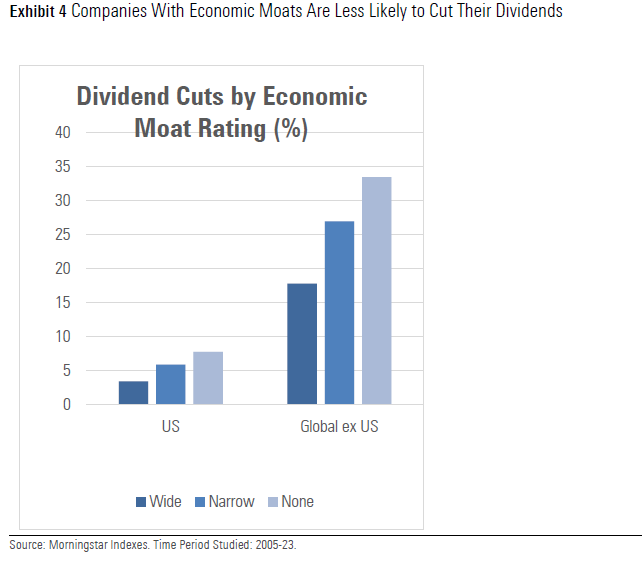

The Morningstar Economic Moat Rating and the Distance to Default financial health metric have been effective screens for dividend-payers, helping to identify recent yield traps like Walgreens and Vodafone.

The future for dividend investing could be brighter than the recent past. A range of factors could lead companies to pay out a greater share of profits as dividends. Meanwhile, Morningstar Equity Research sees value in dividend-rich sectors. Despite its recent struggles, the high-yield section of the equity market has a strong long-term track record.

From one perspective, 2024 will go down as a big year for dividends. Meta Platforms, Salesforce, and Alphabet all initiated quarterly payouts to shareholders. Nvidia announced it would raise its cash dividend by 150%. Among US corporate giants, Amazon.com, Berkshire Hathaway, and Tesla increasingly stand out as nonpayers. Asia and Europe's largest public companies—Taiwan Semiconductor and Novo Nordisk—pay dividends.

While the embrace of dividends certainly validates the centuries-old legacy of companies distributing cash to shareholders, it also comes at a trying time for equity-income investing. First, yields are low. Second, US dividend-payers as a group have delivered subpar total returns recently. In 2023, the Morningstar US High Dividend Yield Index, which represents the higher-yielding half of the US dividend-paying universe by market capitalization, lagged the Morningstar US Market Index by 20 percentage points. So far, 2024 has been another sluggish year.

Third, prominent companies have cut their payouts, illustrating a key risk for equity-income investors. At the start of the year, Walgreens slashed its quarterly dividend by nearly half. Vodafone of the UK also announced a large reduction in its payout. Both stocks offered yields in the region of 10% in 2023. While chasing yield without regard to dividend durability can jeopardize total return, dividend investing remains a sensible means of participating in equity markets. So long as attention is paid to dividend payers’ quality and financial health, the future for equity income investors may be brighter than the recent past.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.