The Takeaway

Using take-private transaction data, quarterly financial statements, and stock price data, we created a neural network to systematically capture the fundamental characteristics of buyout investing within a portfolio of public equities.

We then adjusted this model-based portfolio for leverage and sector exposures to construct a portfolio that replicates a PE buyout strategy: the Morningstar PitchBook Buyout Replication Index.

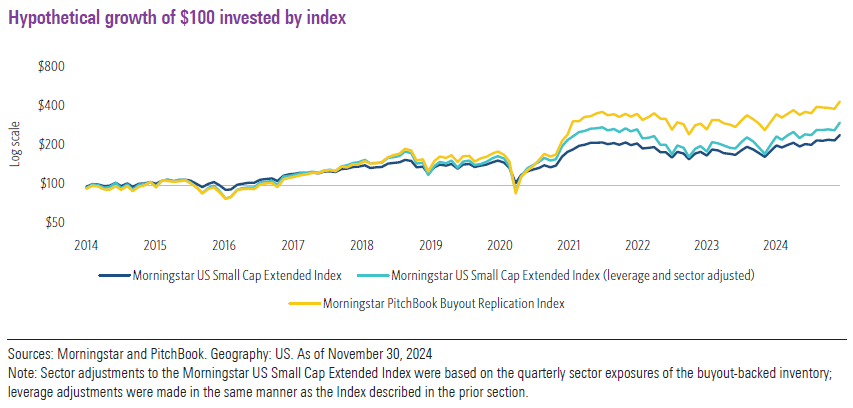

In a backtest starting in 2014 and running through November 2024, the Buyout Replication Index outperformed the Morningstar US Small Cap Extended Index by 6.1 percentage points on an annualized basis. Sector selection, leverage, and security selection contributed 0.9, 1.3, and 3.9 percentage points, respectively, to this outperformance.

While PE buyout is often touted as an alternative investment strategy, it shares many of the fundamental investment characteristics of “traditional” public equity strategies. At their cores, both private and public equity investing involve the ownership of current and future earnings of corporate businesses. By extension, managing a portfolio of private companies has key similarities to actively managing an equity portfolio of public companies in terms of generating excess returns, or alpha. The most important of these similarities is security selection, which involves picking individual companies that outperform, and sector selection, which includes allocating more capital to sectors that outperform. Buyout managers have other tools at their disposal that public equity managers do not, however, given that they typically take a controlling ownership position in their portfolio companies. This provides them with an additional alpha opportunity to improve companies’ operations (known as operational alpha) and the ability to optimize their capital structures, often through an increased allocation to debt.

Outside of operational alpha, which may be less important to the buyout value proposition than advertised, it may be possible to replicate much of the risk/return profile of buyout investing in the public markets. A key component of this replication is a security-selection model that can identify publicly traded companies with similar characteristics to the companies that buyout managers purchase. While there is often little transparency in the companies that buyout managers purchase because most of them are private, take-private transactions of public companies provide a valuable window into their selection criteria. Previous research found that buyout managers tend to exhibit repeatable and predictable patterns in take-private security selection.

Given these patterns, the first step in replicating buyout investing is to build a security-selection model based on take-private transactions that can be used to create a portfolio of public companies with fundamentals that match those of large buyout portfolios—a holdings-based replication approach. Then, we adjust this portfolio’s financial leverage and sector allocations using PitchBook data for the broader universe of private buyout transactions. This process yields the Morningstar PitchBook Buyout Replication Index: a liquid portfolio built for investability that seeks to replicate the core characteristics of buyout investing and, by extension, the performance of illiquid buyout funds.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.