The Takeaway

More than three in four (76%) asset owners globally view increasing trade disputes as material to their investments, with this trend consistent across all regions.

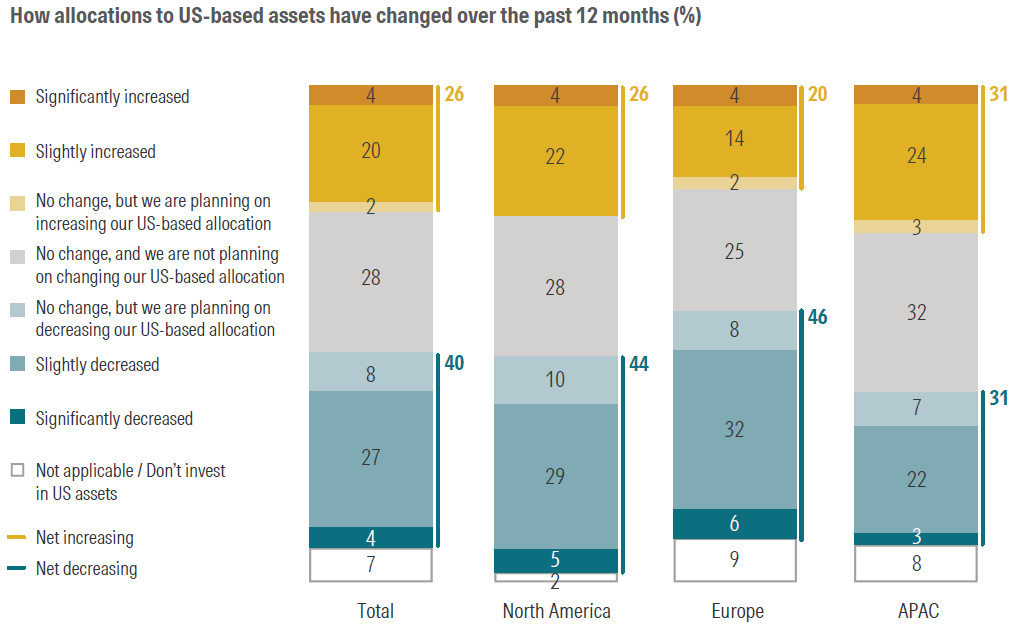

Four in ten asset owners report reducing - or planning to reduce - their allocations to US assets, citing factors like currency risk and policy uncertainty.

Asset owners put climate transition readiness (56%), energy management (48%), and physical climate risks (42%) at the top of their list of most material environmental factors.

In 2024, over one-half (53%) of asset owners surveyed said that ESG considerations go hand in hand with fulfilling their fiduciary duty. As of 2025, this number has increased to 61%.

Institutional investors manage trillions of dollars in assets globally. Because of their size, strategy and systemic impact, these asset owners don’t just participate in markets—they help shape them. Our fourth annual survey of over 500 asset owners globally reveals a community deeply committed to its fiduciary responsibilities, while navigating increasingly significant disruption and uncertainty in capital markets and a complex regulatory landscape.

This year’s findings highlight several emerging trends: a growing consideration of reallocating away from U.S. assets, a widening global divergence in approaches to environmental, social, and governance (ESG) investing—particularly between the U.S. and other regions—increased sophistication in climate strategies and rising support for standardized ESG frameworks and regulation.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.