The Takeaway

Understanding the behavior and accurate measurement of private markets is essential for maintaining trust and transparency among investors, thereby promoting a more stable and robust private equity market.

By leveraging unique datasets, modeling techniques, and market insights, the mark-to-model methodology offers a more holistic view of a unicorn's worth.

This valuation approach forms the foundation for Morningstar’s Global Unicorn Indexes, which will enable quantifying the potential risks and returns of private markets.

Changes in how private venture-backed companies raise capital to fund their growth has altered the nature of capital markets. The implication of these changes is enormous, as private equity allocations occupy a considerable share of institutional portfolios and are gaining popularity in retail portfolios, too. However, accurately measuring the returns and risks of late-stage venture investments can be challenging without the right tools. We introduce a new mark-to-model approach to value venture-backed companies. The model supports the creation of benchmarks that will provide more timely insights into the late-stage venture market and improve the understanding of the behavior of this market. Ultimately, it will aid in making better decisions regarding asset allocation and portfolio construction.

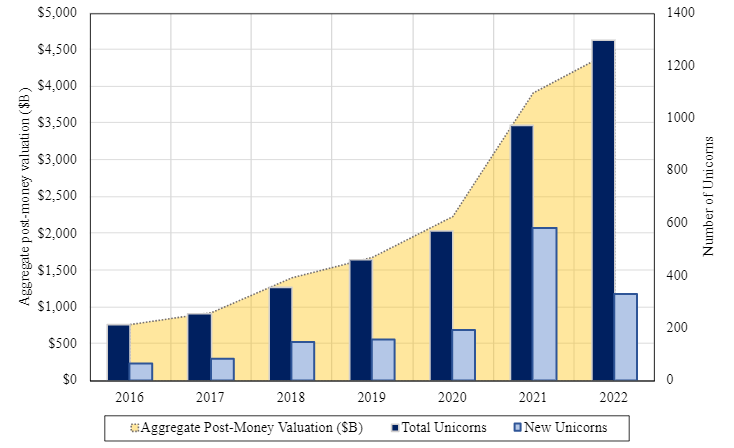

Growth of Unicorns by Number and Assets

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.