The Takeaway

The Morningstar PitchBook Developed Markets Listed Private Equity Index tells the story of a secular trend: the boom in private markets.

Measuring private-market performance through private-capital funds, the Morningstar PitchBook Global Unicorn Index, and returns for mutual funds with private holdings reveals a mixed picture.

For private markets managers, "Convergence" represents both a threat and an opportunity. For investors, an altered opportunity set has real impact—small-cap US equities leveraged loans are two examples.

What's the better investment—a mutual fund or a mutual fund company? Morningstar analysts tackled this question several times in the 1990s and 2000s, comparing the returns of funds to the share price performance of public fund managers. Data typically favored the latter. This pointed to the asset-light, scalable nature of the investment management business and to what Vanguard founder Jack Bogle called the inherent conflict of serving "two masters"—fund investors and fund company investors.

Times have changed. Several headwinds face the asset management industry, including fee compression, the shift to passive investing, regulatory changes, distribution costs, and an aging population. Indeed, the Morningstar Global Asset Management Index has lagged the broad equity market over the past decade.

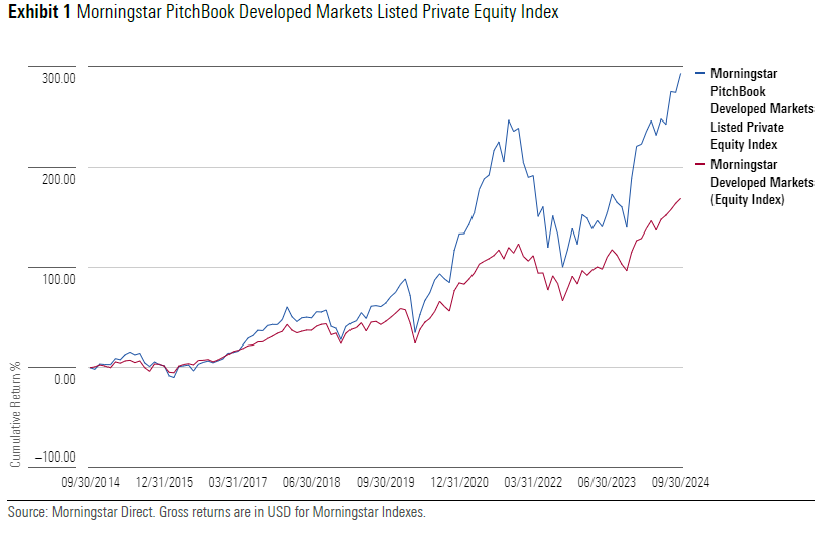

Managers focused on private markets have fared much better. The Morningstar PitchBook Developed Markets Listed Private Equity Index has gained nearly 300% in cumulative terms for the 10 years through 2024’s third quarter, compared with 169% for its parent benchmark. Constituent companies like Blackstone, KKR, Partners Group, Ares, and ICG have seen their share prices surge.

Their success begs several questions. First, do these managers outperform their private-market investments? Second, what does the future hold for private-market investing? Third, how have public markets have changed as a result of private market expansion?

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.