The Takeaway

More than two-thirds of asset owners (67%) believe ESG has become more material to investment policy in the past five years, with environmental factors driving materiality.

Climate is king among environmental considerations, while diversity and inclusion rank highly on the social front.

Regulatory confusion is a significant challenge for asset owners, with the lack of clarity and rising costs cited as particular pain points.

As stewards of some of the largest pools of capital in the world, asset owners are a critical part of the global market ecosystem. As fiduciaries for their key stakeholders and plan participants, they are sounding boards on global markets, investment policies and standards. As our clients, asset owners tell us what they need in terms of support to help them meet their challenges, such as market data, indexes, tools, research, and insights.

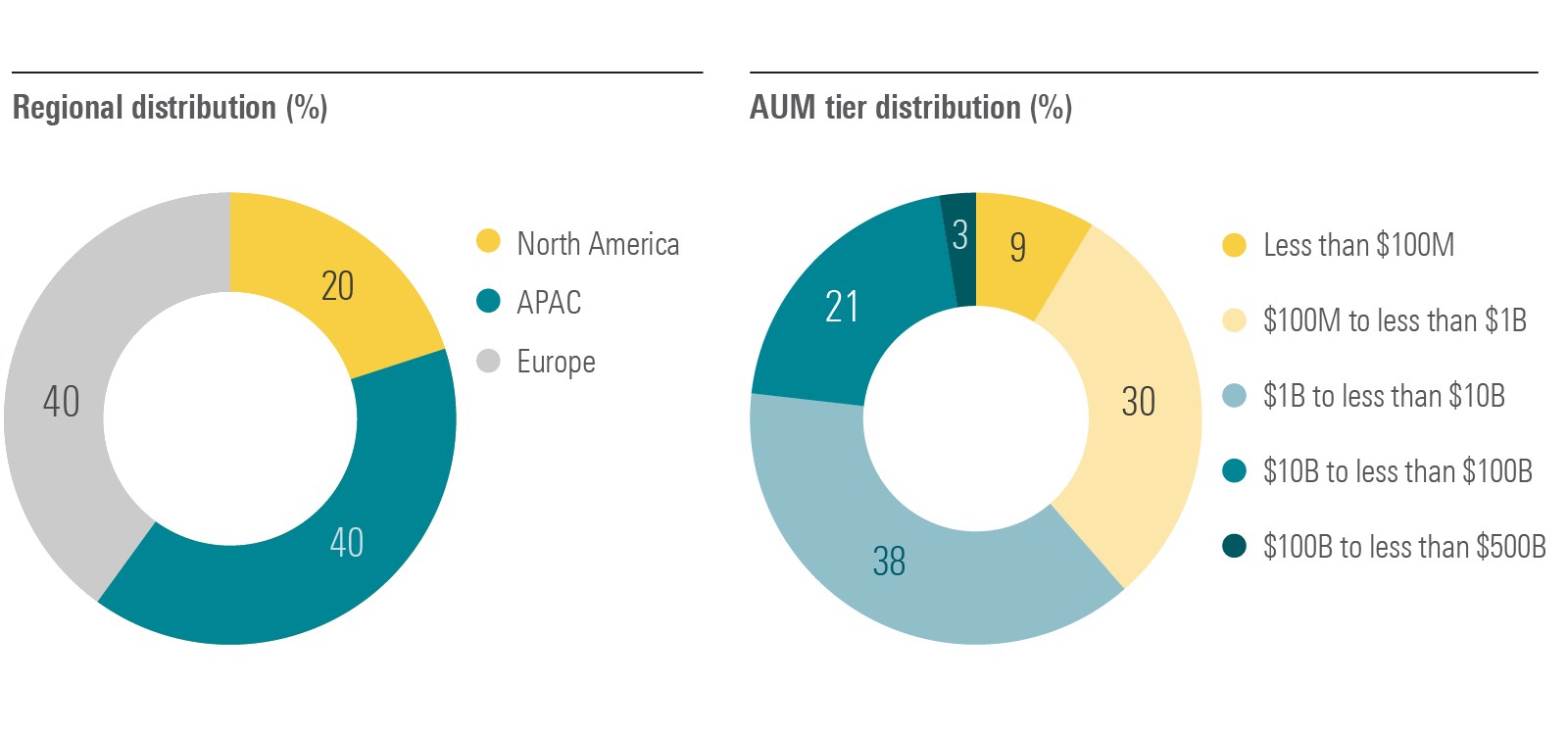

With the help of Opinium Research, for the quantitative phase of our 2023 Voice of the Asset Owner Survey we gathered the responses of 500 asset owners representing combined assets under management (AUM) of over $10.7 trillion. Geographically, the survey spanned 11 countries with 100 total respondents from North America (US & Canada) and 200 respondents each from Europe and APAC.

Our 2023 study confirms many of the baseline assumptions we gleaned from our inaugural study last year, while also helping us identify emerging trends and new insights.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.